Cook County Property Tax Deja Vu: Multiplier Up, Homeowners’ Share Down

Cook County Property Tax Deja Vu: Multiplier Up, Homeowners’ Share Down?

February 2021 (74.1)

by Mike Klemens*

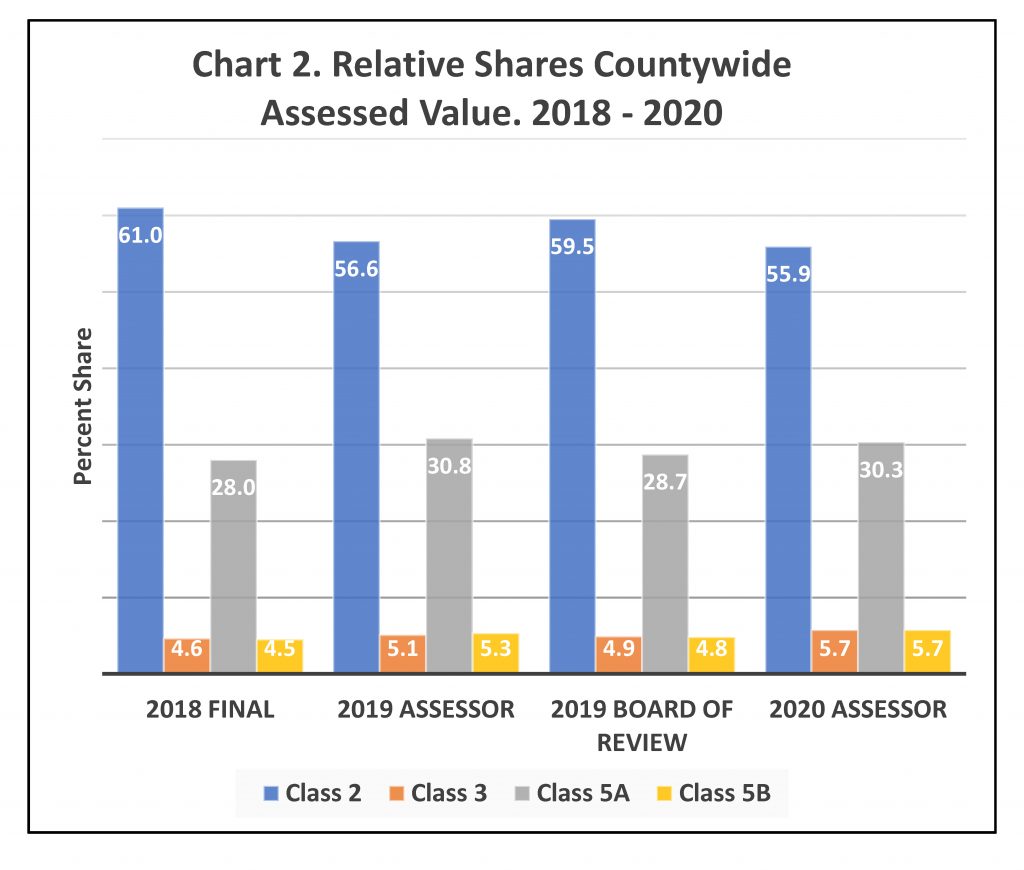

For Cook County property tax bills that will be issued in June, the Illinois Department of Revenue (IDOR) has calculated a tentative property tax multiplier of 3.0861. When finalized, it will be at least the third highest multiplier ever. While many assume that the increased multiplier will increase their taxes, that is not generally true. In this article we will examine what the calculations behind the new tentative multiplier say about Cook County property taxation and a continuing shift off residential onto business properties.

The annual outside view of Cook County assessments provided by the IDOR multiplier shows two trends. First, for the second consecutive year properties in Cook County have been assessed at a declining percentage of actual value (the shorthand is that the “level of assessment” has fallen). Between taxes payable in 2020 and taxes payable in 2021, the three-year average countywide level of assessment fell from 11.43 percent to 10.80 percent, causing the tentative multiplier to increase 5.8 percent from last year’s figure of 2.9160. The level will almost certainly fall farther (and the multiplier will increase more) when the Board of Review completes its actions on assessment appeals later this spring and IDOR incorporates them into the final multiplier. The second trend the multiplier calculations illustrate is the continuing shift off residential properties onto commercial, industrial and apartment properties.

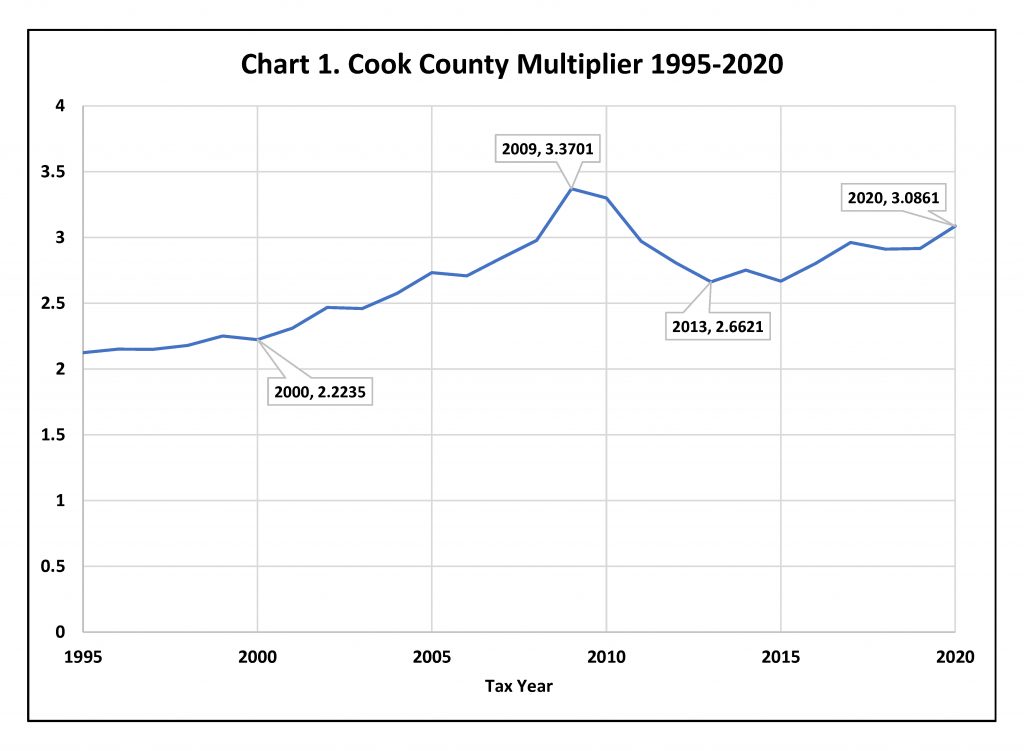

The multiplier (formally termed the equalization factor) fulfills an Illinois constitutional requirement that all property taxes in Illinois be “levied uniformly by valuation.” State law sets the assessment level at 33.33 percent of market value and each year IDOR calculates and issues an equalization factor for each county to bring the three-year average level of assessment to 33.33 percent. Chart 1 shows a 25-year history of the Cook County multiplier.

Cook County’s unique classification system that values various classes of property at different percentages of market values causes it to have the highest multiplier of any county. In all other counties all property is supposed to be valued at 33.33 percent of market value and the multiplier is close to 1; in Cook residential properties are supposed to be assessed at 10 percent of market value and commercial and industrial properties at 25 percent of market value and the multiplier approaches 3. Residential properties make up 80 percent of the base, so Cook will always have a multiplier greater than 2.50.

The decreasing level of assessment (and the increasing multiplier) comes in the second year of an effort by Cook County Assessor Fritz Kaegi to reform a property tax system that has been plagued with a lack of uniformity in property tax assessments. According to the latest IDOR sales ratio study, before Kaegi took office the Coefficient of Dispersion, a statistical measure of average assessment error, was 50 percent for apartment and commercial properties, 33 percent for industrial properties, and 21 percent for residential properties. The national standards promulgated by the International Association of Assessing Officers say that residential CODs should be no more than 15 percent, while those for apartment, commercial, and industrial properties should not exceed 20 percent.

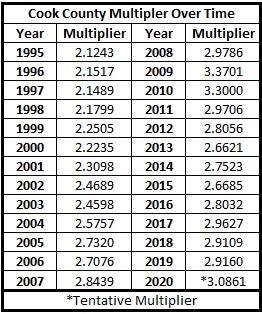

The primary reason for this year’s big jump in the multiplier is an adjustment that the assessor made to numerous properties in all three county triads to account for the economic effects of the COVID pandemic. The overall assessed value of property countywide fell almost 1 percent, from $68.4 billion to $67.9 billion. In terms of countywide assessed value, between 2019 and 2020, the assessor dropped residential properties (Class 2) 7.2 percent; at the same time he increased apartments (Class 3) 7.1 percent, commercial properties (Class 5A) 3.8 percent, and industrial properties (Class 5B) 15.1 percent.

Most significantly, the COVID reductions were made countywide and not just in the South Triad that was reassessed for 2020. This is a departure from the normal process where only one of three triads is reassessed and assessments are held constant in the other two. The changes in the county’s 2020 tax roll reflect growth in South Triad property values between 2017 and 2020, plus new property added in all three triads since 2019, minus the COVID adjustments in all three triads.

There is also an interaction between steep countywide COVID reductions and the IDOR methodology for computing the 2020 multiplier. The Department of Revenue computed the 2020 multiplier (for taxes to be paid in 2021) by taking the average countywide assessment levels for its 2017, 2018, and 2019 sales ratio studies, and modifying each year’s level to reflect the reassessment done in 2020, and averaging the three countywide levels. When the 2020 COVID adjustments were applied to each year’s ratio study, the three-year average countywide level of assessment declined and boosted the multiplier.

The higher multiplier will mean that Cook homeowners who are receiving a COVID adjustment that reduces their assessed values (AVs) will not see their taxable value (Equalized Assessed Values) go down by the full amount of the adjustment. A business property that did not receive a COVID adjustment will see its taxable value increased. However, the higher multiplier will be better news for South Triad local governments, who will see EAV growth both from reassessment and the higher multiplier that may allow them to reduce already high tax rates.

Homeowners will believe the multiplier increases their taxes. That’s because their bill is calculated by multiplying their assessed value (AV) by the multiplier to create their Equalized Assessed Value (EAV), from which any homestead exemption is taken, then this final taxable value is multiplied by the tax rate to determine the tax due. The multiplier increases the EAV and, it appears, their tax bill. What is not so obvious is that the tax rate is dependent upon overall EAV: a higher multiplier produces a higher overall EAV, which in turn produces a lower tax rate. The multiplier is applied to each parcel of property in the county and itself does not increase taxes.

Two things determine whether a property owner will see higher taxes: (1) whether the amount of taxes requested by taxing districts (the levy) has increased and (2) whether the property’s relative share of the total property has changed. See Tax Facts, December 2020, “Cook County Property Tax Assessment Reform: the Perfect Storm of Who Pays What.” Because the COVID adjustments, in particular, shift the relative shares of property in the tax base off residential property, homeowners will bear less of the tax burden while businesses will bear more.

Chart 2 shows the countywide changes in relative shares of assessed value carried by the four major classes of property (i.e. residential (Class2), apartment (Class3), commercial (Class 5A) and industrial (Class 5B) for last year (2019 taxes paid in 2020) and this year (2020 taxes payable in 2021). Last year in the North Triad the assessor changed relative shares by increasing the three business classes more than the 3.7 percent he increased residential values. When the Board of Review cut back on business class increases, homeowners’ relative share increased, but remained below where it was before reassessment. This year the application of COVID adjustments countywide again impacted relative shares, boosting business properties’ share of the tax base. The shifts may seem small on a percentage basis, but each 1 percent change means about $160 million in taxes. That means, if the assessor’s changes hold, since 2018 about $800 million in taxes have been shifted off residential class properties onto the three business classes.

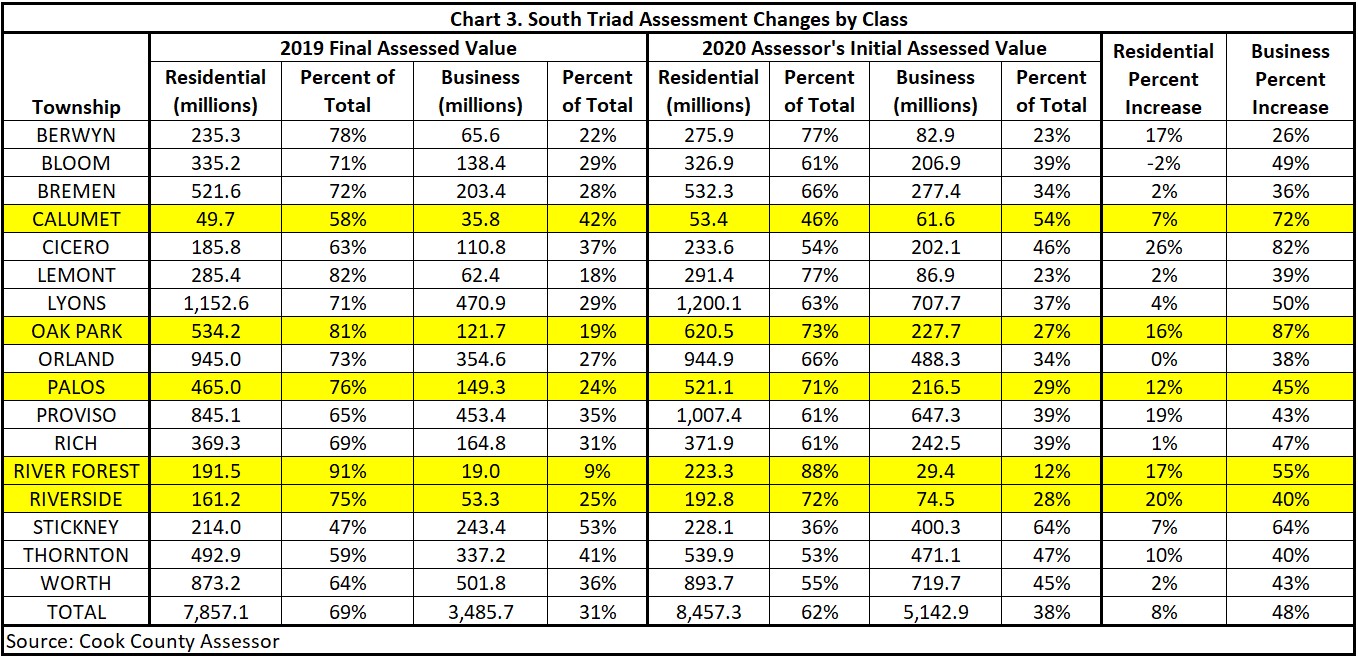

The same pattern emerged this year in the South Triad. Chart 3 shows changes in the South Triad assessments and illustrate the greater increases on business properties and the shift of relative tax burden off residential properties. Townships marked in yellow are before COVID adjustments. Unknown is what effect the Board of Review actions will have on final assessments and relative shares. Last year in the North Triad, double digit reductions in industrial and commercial assessments by the Board of Review caused the countywide level of assessment to decline and the tentative multiplier of 2.7523 to jump to 2.9160. If property owners are similarly successful in challenging assessments this year, we may see a similar jump in the multiplier and a reduction in the shift onto business properties.

Conclusions (so far) for 2020 taxes to be paid in 2021

- Countywide COVID adjustments reduced the overall assessed value of property in Cook County, but with the multiplier the overall taxable value (EAV) will increase.

- The South Triad reassessment continued the trend begun last year in the North Triad of decreasing residential property’s relative share of property taxes.

- Countywide the assessor dropped assessments 7.2 percent for residential properties (Class 2), and increased assessments 7.1 percent for apartments (Class 3), 3.8 percent for commercial properties (Class 5A), and 15.1 percent for industrial properties (Class 5B).

- The state multiplier will not raise individual property owner’s tax bills; increases in local governments’ tax levies and an individual property’s relative share of the tax base will increase an individual property owner’s tax bill.

We’ll have to wait another year to see whether the assessor’s office guessed correctly when it reduced residential properties’ assessments approximately 10 percent countywide. Assessment increases released later this year for Chicago residences that saw a COVID-related break last year could be quite steep. And by then the economic effects on downtown business property values should be better known.

*Mike Klemens does tax policy research for the Taxpayers’ Federation of Illinois.