The Proposed Graduated Income Tax in Illinois – A Closer Look

The Proposed Graduated Income Tax in Illinois – A Closer Look

August/September 2020 (73.6)

Illinois’ current income tax is commonly referred to as a “flat” tax, meaning there is only a single tax rate, rather than a “graduated” tax structure, where different rates apply to different levels of income. This is, as of right now, our only option. The first sentence of Section 3(a) of Article IX of the Illinois Constitution of 1970 provides as follows:

A tax on or measured by income shall be at a non-graduated rate.

This was the first time an Illinois state constitution explicitly referred to an income tax at all, and although in 1969 the Illinois Supreme Court held that such a tax was permissible under the 1870 constitution, the new constitution set out parameters, conveniently aligned with the tax already in place. In other words, a “flat tax” is constitutionally required, and all we’ve ever known (at least at the state level), in Illinois.

That might change. A measure on the ballot in November would remove this requirement by amending Section 3(a). If (and only if) the constitution is amended, a new graduated rate structure goes into effect January 1. The rates and brackets for taxpayers filing joint returns, as codified in Illinois Income Tax Act Section 201.1, are set forth on page 2:

Taxable Income Tax Rate

$0 – $10,000 4.75%

$10,001 – $100,000 4.9%

$100,001 – $250,000 4.95%

$250,001 – $350,000 7.75%

$350,001 – $1,000,000 7.85%

$1,000,000 and up 7.99% on all income

These are also the rates and brackets for single and married filing separate filers, except that their top bracket begins at $750,000

The arguments for and against amending the constitution are largely political and philosophical. Proponents call it the “fair tax” and focus on the direct consequences of the new rate structure (high income individuals will pay more in tax; additional revenue will be raised). Opponents call it the “jobs tax”, arguing that the current structure is fair, and that higher taxes will drive away businesses and require more tax increases, this time impacting more Illinoisans. Few of these arguments directly implicate tax policy, although as discussed below there are tax policy considerations.

This article begins by comparing Illinois’ current and proposed new tax regimes with those in place in other states, focusing on the actual tax liability of sample taxpayers. We then examine some of the technical tax issues associated with graduated tax structures in general and Illinois’ current proposal in particular. Finally, we look at the concept of a graduated income tax structure through the lens of the tenets of sound tax policy as set forth in TFI’s Statement of Principles. Previous issues of Tax Facts have discussed these and other angles of a graduated income tax structure. See, for example, April/May 2019, September/October 2016, and April/May 2014.

WILL ILLINOIS BECOME A HIGH INCOME TAX STATE (or are we already)?

It’s easy to compare tax rates from one state to another. That does not necessarily equate to actual tax liability, however. A number of other things, like exemptions, credits, and filing classifications, also impact the amount of tax due. One way to compare state tax burdens is to look at total tax revenues as a percentage of that state’s economy. See TFI’s publication, Tax Facts: An Illinois Chartbook, for an illustration of how Illinois has historically compared to the national average when you look at all state and local taxes (page 19) (a more holistic comparison) or at individual income taxes (page 24) (our focus here). In both, we have traditionally been lower than the national average, but are now above average (based on preliminary data).

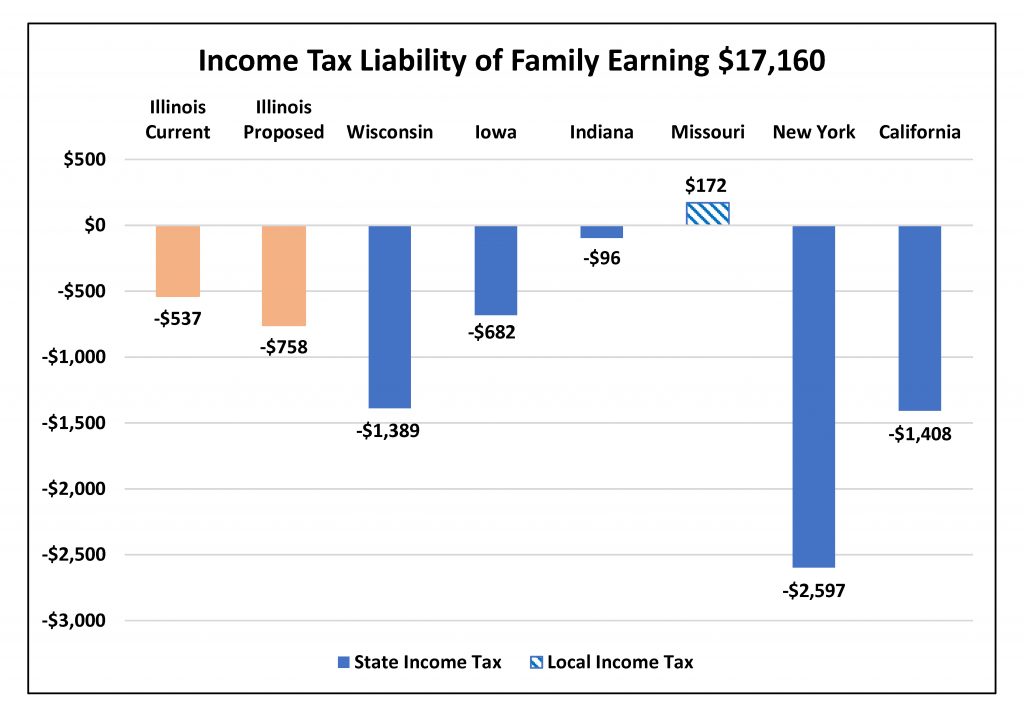

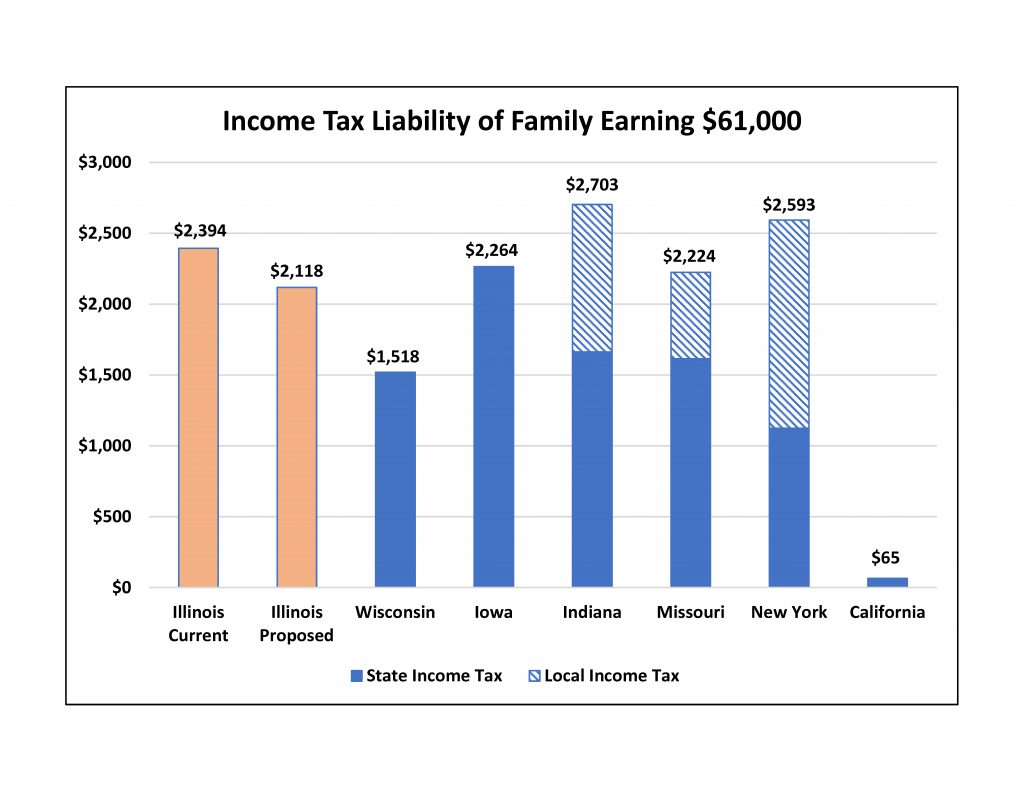

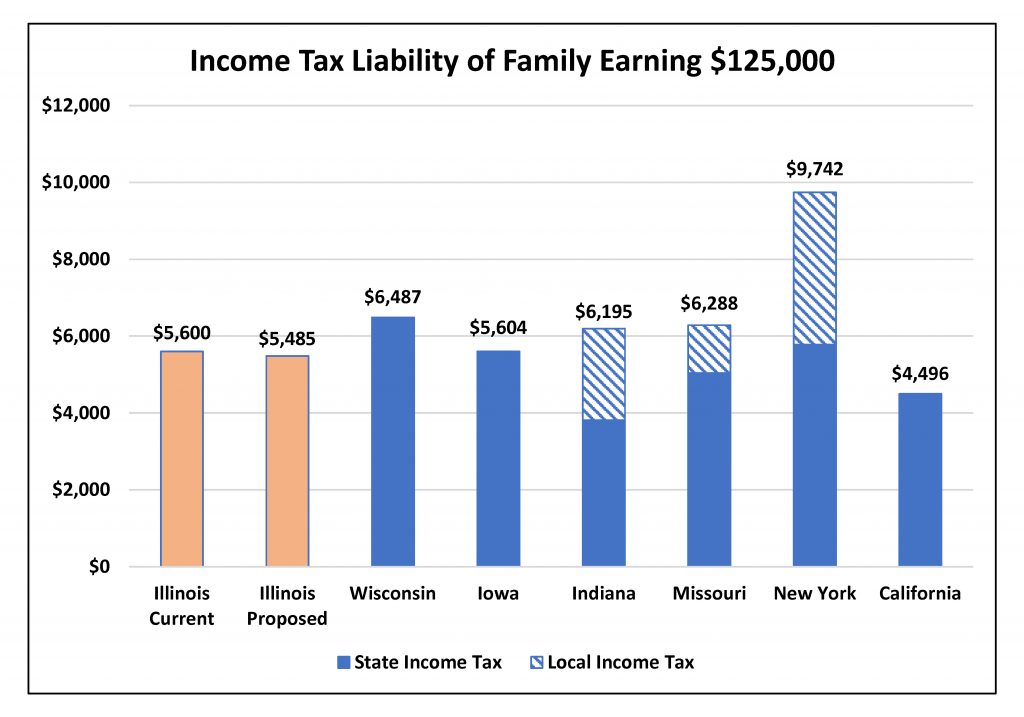

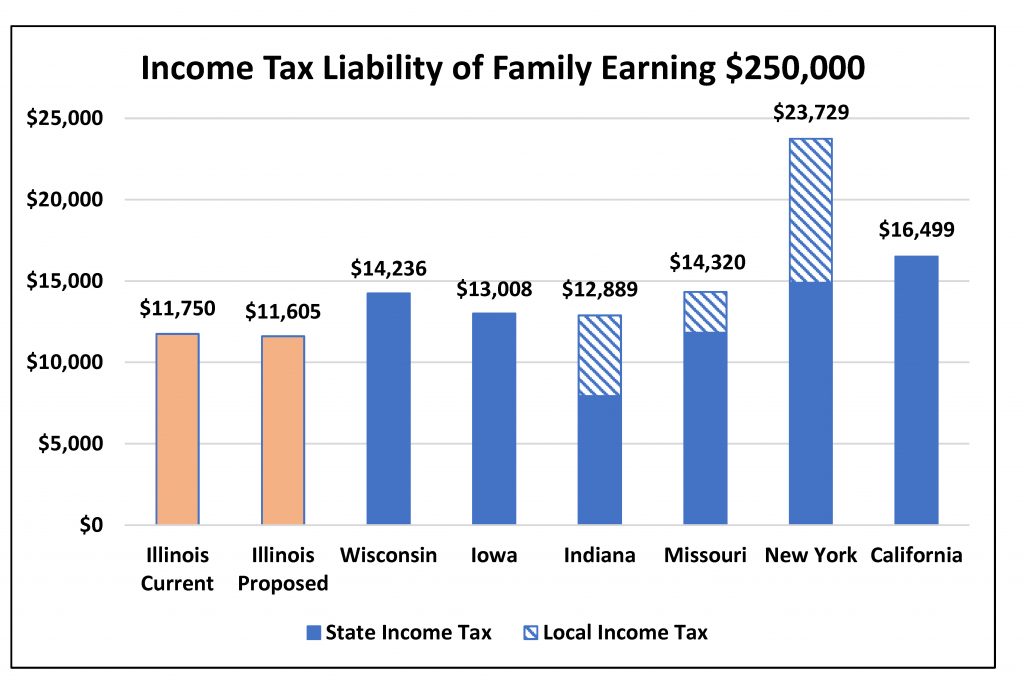

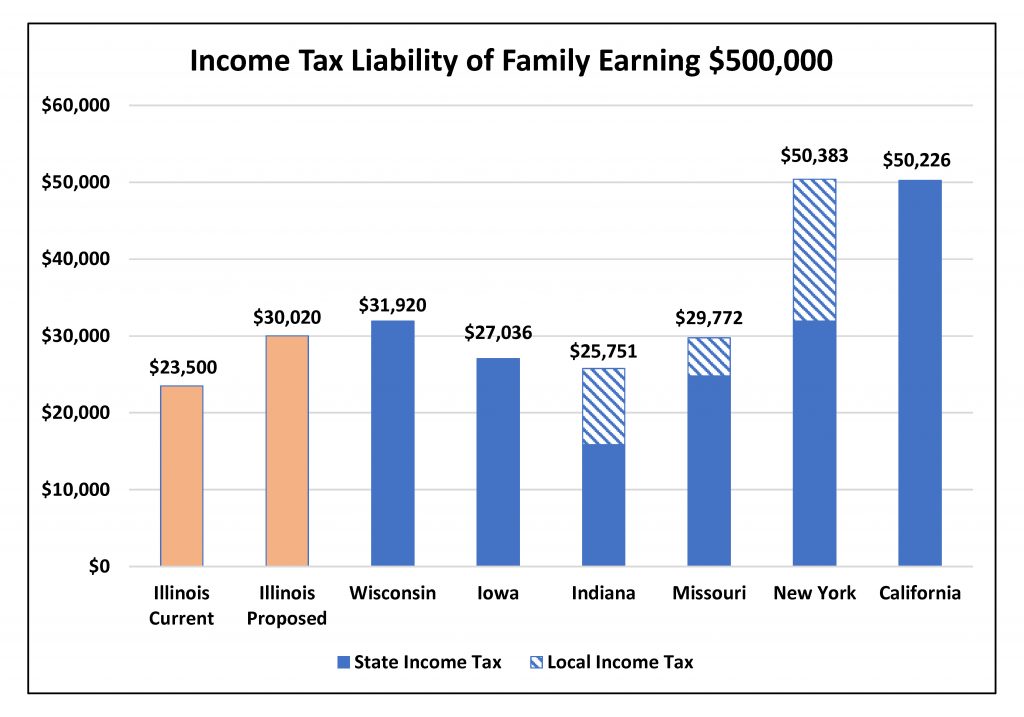

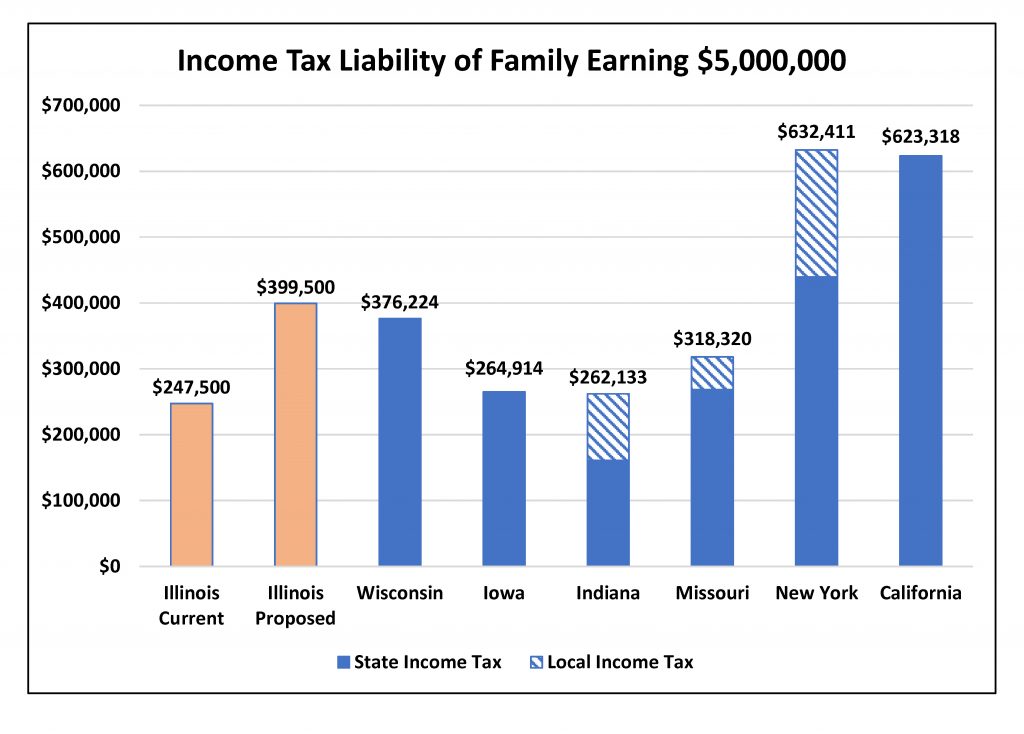

In order to evaluate the consequences of Illinois’ proposed graduated rate structure to taxpayers, we have calculated the likely tax burden of a variety of sample taxpayers, both in Illinois (before and after the proposed changes) and in a few of our neighboring and peer large states (using the laws in place in 2019).

When Governor Pritzker unveiled his proposed graduated rate structure in 2019, he used six sample families of varying incomes to show how they fare under Illinois’ current tax structure and how they would fare under the proposal:

- Single parent that rents with two children earning $17,160

- Married couple with two children that earns $61,000 and pay $3,500 in property taxes

- Married couple with one child that earns $125,000 and pay $5,000 in property taxes

- Married couple with no children that earns $250,000 and pay $8,000 in property taxes

- Married couple with two children that earns $500,000 and pay $16,000 in property taxes

- Married couple with one child that earns $5,000,000 and pay $8,000 in property taxes

We use these same sample families in our analysis, applying the rates and other changes in the income tax law that will go into effect on January 1, 2021, if the constitution is amended. It is important to note that not all states have individual income taxes, including Florida and Texas. All six sample families would pay $0 in income taxes in those states.

A few thoughts about comparing states:

Effective rate vs. marginal rate – A “marginal” tax rate is the rate applied to the last dollar of income a taxpayer earns. When a state has a flat rate structure, as Illinois does now, the top marginal rate is the same for every taxpayer because all income for all taxpayers is taxed at the same rate. Traditionally, in a graduated rate structure, the only income subject to the higher tax rates is the income in that particular bracket; the taxpayer’s first dollar of income is still subject to the lower rate applicable to all taxpayers in that bracket. Focusing solely on the marginal rate, then, is overly simplistic: a taxpayer earning $250,001 would be in the “over $250,000” bracket, but only $1 of income would be subject to that tax rate. This is why we have calculated actual tax liability, and from there could calculate “effective rate”, which compares taxable income to taxes actually paid—essentially a blended or weighted average rate.

Local taxes – Indiana, Iowa, Missouri, and New York all have local income taxes. In our calculations, we assumed the family lived in the most populous part of the state and would be subject to those local income taxes. In Iowa, while 85% of school districts have an income surcharge tax, Des Moines does not. In Indiana, counties are able to impose a county level income tax. Indianapolis is in Marion County which imposes a 2.2% income tax. Kansas City and St. Louis both have an earnings tax of 1%. Finally, New York City imposes a graduated income tax on its residents with a top rate of 3.876%.

Family One would not pay tax in any of the selected states, other than local income tax in Missouri. Many states, like the federal government, have an earned income tax credit or similar benefit program assisting the working poor that results in a negative tax liability—a cash payment from the government. This is the case in all of the sample states except Missouri. If the constitutional amendment passes, Illinois’ tax rate for Family One will drop, and they will be eligible for a new child tax credit, giving this family a larger refund.

Family Two sees a substantial swing in tax liability among our selected states, ranging from $65 in California to $2815 in New York. The Illinois income tax bill for this family lies between those extremes. Under the proposed new structure, their liability would decrease by 12%, or $276. The family would have a higher income tax liability in Iowa, Indiana, and Missouri.

The 2021 tax structure (if it goes into effect) would reduce Family Three’s Illinois income tax liability by 2%, or $115. The reduction doesn’t change Illinois’ ranking among the selected states for this family (6th out of 7).

If the constitution is amended, income over $250,000 would be taxed at a higher level than it is now. Family Four makes exactly $250,000, however, and would see a decrease of $145 or 1.2%. Despite Illinois’ reputation as a high-tax state, this family currently pays (and would continue to pay) lower income taxes in Illinois than in all of the selected states.

Family Five is the first sample scenario that would see their income tax increase, from $23,500 to $30,020, or 28%. Currently, this family pays less in income taxes in Illinois than they would in any of the selected states. After the increase, they would pay more in three of our selected states and less in three, putting Illinois right in the middle.

If the constitution is amended, Family Six would see their income tax liability increase by 61%, or $152,000. Like Family Five, their current tax liability is lower in Illinois than all of the other selected states. If the constitution is amended, they would have lower liabilities in four of our selected states and higher liabilities in two.

What does this mean? How Illinois compares to other states, when making the comparison using actual tax liabilities, has always differed by the taxpayers’ income level. The tax changes that will go into effect if the constitution is amended will change tax liabilities for nearly every Illinois taxpayer, one way or another. But, as our charts show, the changes in how Illinois fares in a state-to-state comparison will be most dramatic for those at the highest income levels.

FROM A PRACTICAL PERSPECTIVE

There are a number of practical considerations that arise when considering the graduated rate proposal in Illinois, some inherent in a graduated rate structure, and some raised by the specifics of the Illinois structure that will go into effect January 1, 2021 if the constitution is amended. We discuss several of these below.

- The “cliff”.In a typical bracket structure, all taxpayers, even those in the very highest income levels, benefit from the lower rates applicable at the lower levels. It is only the income over each threshold amount that is taxed at the next higher rate. Illinois’ bracket structure contains a fairly unusual provision, providing that all income earned by taxpayers in the highest bracket (taxable income over $1,000,000 or $750,000 for single taxpayers), is taxed at the highest rate, rather than continuing to tax the first $10,000 of income at the lowest rate, the next $90,000 at the next rate, and so on. The impact of this on taxpayers earning just over that threshold will be significant. A married couple earning exactly $1,000,000 will still be able to use the bracket structure, paying $71,085 in tax. If their income increases to $1,000,001, the top rate of 7.99% will apply to all of that income, for a tax liability of $79,900. That’s a tax increase of $8,815 on $1 of additional income. Other states and the federal government have occasionally tried to phase out the benefit of the lower bracket rates for high income earners, but we found none that did it in such an abrupt manner.

- Marriage penalty (or bonus). A marriage penalty or bonus is the change in a couple’s total tax bill under a graduated rate structure as a result of filing their taxes jointly.

- Marriage penalties occur when two individuals with equal incomes marry. If Taxpayers A and B each earn $200,000 after all deductions and exemptions, under Illinois’ new structure they would each pay $9,835 in tax for a total of $19,670. After A and B marry, their total income would be $400,000, and because some of that income would be subject to tax at higher rates, the tax due would be $23,985, an increase of $4,315 on the same total income.

- Marriage bonuses typically occur when two individuals with disparate incomes marry. Illinois’ proposed new structure will only offer a marriage bonus at the higher income brackets, because it is only there where the single and joint filing brackets differ (softening the blow of the marriage penalty). If taxpayer C earns $50,000 and D earns $800,000, C pays $2,435 in tax and B is in the 7.99%-on-all-income bracket (which kicks in for individuals at $750,000), paying $63,920, for a total tax of $66,355. After C and D marry, their $850,000 in total income would be below the $1,000,000 top bracket for joint filers, resulting in $59,310 in tax.

It is almost impossible to structure a bracket system that avoids marriage penalties and bonuses, short of eliminating joint filing. Iowa, for example, uses the same rates and brackets for all taxpayers, so there is no marriage bonus, but it allows married taxpayers to choose to file jointly or separately on the same return, meaning they can avoid any potential marriage penalty.

- Part-year residents and nonresidents. Assume two taxpayers, X and Y, have identical jobs, both paying $300,000 per year. Taxpayer X lives and works in Illinois for the full year. Under the new structure (if it goes into effect), the top tax rate applicable to Taxpayer X’s income will be 7.75%. Taxpayer Y lives and works in Indiana for the first 6 months of the year, then moves to Illinois and works here for the rest of the year. Illinois will only tax half of Taxpayer Y’s income—the $150,000 earned while living and working here. But what rate(s) will apply? Should the tax liability be calculated as if Taxpayer Y lived here all year, then adjusted to reflect the part-year status, meaning the top marginal rate will be 7.75% for Taxpayer Y, just like for Taxpayer X? This might be more fair, but it is more complicated. Or, should Taxpayer Y simply apply the rates relevant for $150,000 in income? Illinois law has no current mechanism to address this issue.

- Inflation. Assume a taxpayer earns $230,000. The top marginal rate under Illinois’ new structure (if the constitution is amended) will be 4.95%. Over time, our Taxpayer receives cost-of-living raises each year. Before long, she will move up a bracket and see a top marginal rate of 7.75%. This is a huge jump in tax rates when there has been no increase in buying power. Many states have addressed this concern by indexing their brackets to inflation. Illinois’ new structure does not do so.

- Brackets or a surcharge? On its face, Illinois’ proposed new structure will have 6 brackets, with 6 different tax rates. For all practical purposes, however, the first 3 brackets—4.75%, 4.9%, and 4.95%–are indistinguishable and effectively all income up to $250,000 will be taxed at just under 5%. Similarly, the next 3 brackets—7.75%, 7.85% and 7.99%–tax income over that $250,000 threshold at just under 8%. Illinois’ 6 brackets boil down to two; one for 97% of Illinois taxpayers, according to the measure’s proponents, and a much higher one for the remaining 3%.

TAX POLICY CONSIDERATIONS

Although most of the arguments for and against the graduated tax amendment do not rely on tax policy, tax policy should of course be considered when such a significant change in tax structure is proposed. TFI’s Statement of Principles revolve around the tenets of sound tax policy: adequacy, stability/predictability, fairness, simplicity, and efficiency. Each of these is relevant when considering any kind of income tax, although some more than others, as the discussion below indicates.

Adequacy. A tax structure must raise enough revenues to properly fund government operations. How high those levels should be reflects the needs and priorities of the community. A graduated rate system does allow for more nuanced tinkering with tax collections—if revenues are considered to be too high or too low, the legislature can adjust rates and brackets for only some taxpayers, rather than all, to more precisely match revenues with expenses. On the other hand, as discussed in more detail below, an income tax reliant on more volatile incomes will itself be more volatile, making it potentially more difficult to raise adequate revenues during economic downturns and requiring the state to create and fund a meaningful rainy day fund, something which Illinois has not yet been able to do. The graduated rate proposal, like any income tax, neither fails nor passes this particular “test”, when considered in isolation; adequacy looks at the overall portfolio of revenue sources.

Stability/Predictability. This principle is considered from both the taxpayer’s and government’s perspective. Income tax is one of the most volatile tax types, and higher income taxpayers tend to have more volatile incomes (and therefore tax liabilities). (See the April/May 2019 issue of Tax Facts for a more thorough discussion of this phenomenon.) The new graduated tax structure (if it goes into effect) is designed to raise additional taxes, meaning the state will be relying more heavily on an unstable revenue source. In other words, income taxes generally don’t fare well on this measure from the government’s perspective, and a graduated rate structure can amplify that. If the rates and brackets are clearly set forth and not subjected to frequent change, taxpayers should have a reasonable level of predictability.

Equity/Fairness. What, exactly, is a fair tax? Much of the debate over the constitutional amendment revolves around this very question. Opinions range widely, and almost always reflect underlying personal philosophical and political points of view, rather than tax policy. One aspect of fairness, called horizontal equity by economists, merely means that similarly situated taxpayers should have similar tax burdens, and a graduated rate structure meets that requirement. Vertical equity, on the other hand, looks to how taxpayers at different income levels are treated. To some, a graduated tax structure is a “fair tax,” to others it fails this test miserably.

Collectibility/Transparency/Simplicity. These measures apply primarily to tax compliance and administration. As described above, there are some complications associated with a graduated income tax structure that flat taxes generally avoid, so the graduated rate proposal falls short on this measure.

Efficiency. Taxes should not distort economic behavior. As taxes get more complicated, particularly if they are also increasing, there is more opportunity and motivation for taxpayers to expend time and energy minimizing taxes, and business and personal decisions may be influenced by the tax consequences. In other words, graduated rate structures tend to decrease tax efficiency, particularly as rates increase.

WHAT’S NEXT?

The decision to adopt a graduated rate structure in Illinois lies with the voters. If the constitutional amendment passes, our income tax will become a bit more complicated, more volatile, and for some taxpayers, higher. The tax increase may motivate some of those high-income earners to shelter income or even move to another state, although many neighboring and comparable states will still impose higher taxes than Illinois (depending on the taxpayer’s income level).

Conversely, if the amendment does not pass, Illinois’ fiscal woes will not disappear. The legislature will need to balance the budget without the new revenue from this proposal and will instead need to look to other sources, cut spending, or a combination of both.