TFI Tax Facts (77.3): Fun Facts for Tax Day

TFI Tax Facts: Fun Facts for Tax Day

April 2024 (77.3)

With tax day upon us, this issue of Tax Facts focuses on some of the who-what-where questions around filing individual income tax returns in Illinois. How many people file returns, and how? Where do they live? How many tax benefits do they receive? We discuss the answers to these and other questions associated with this time of year.

How are Returns Filed, and by Whom?

Source: Illinois Department of Revenue

Source: Illinois Department of Revenue

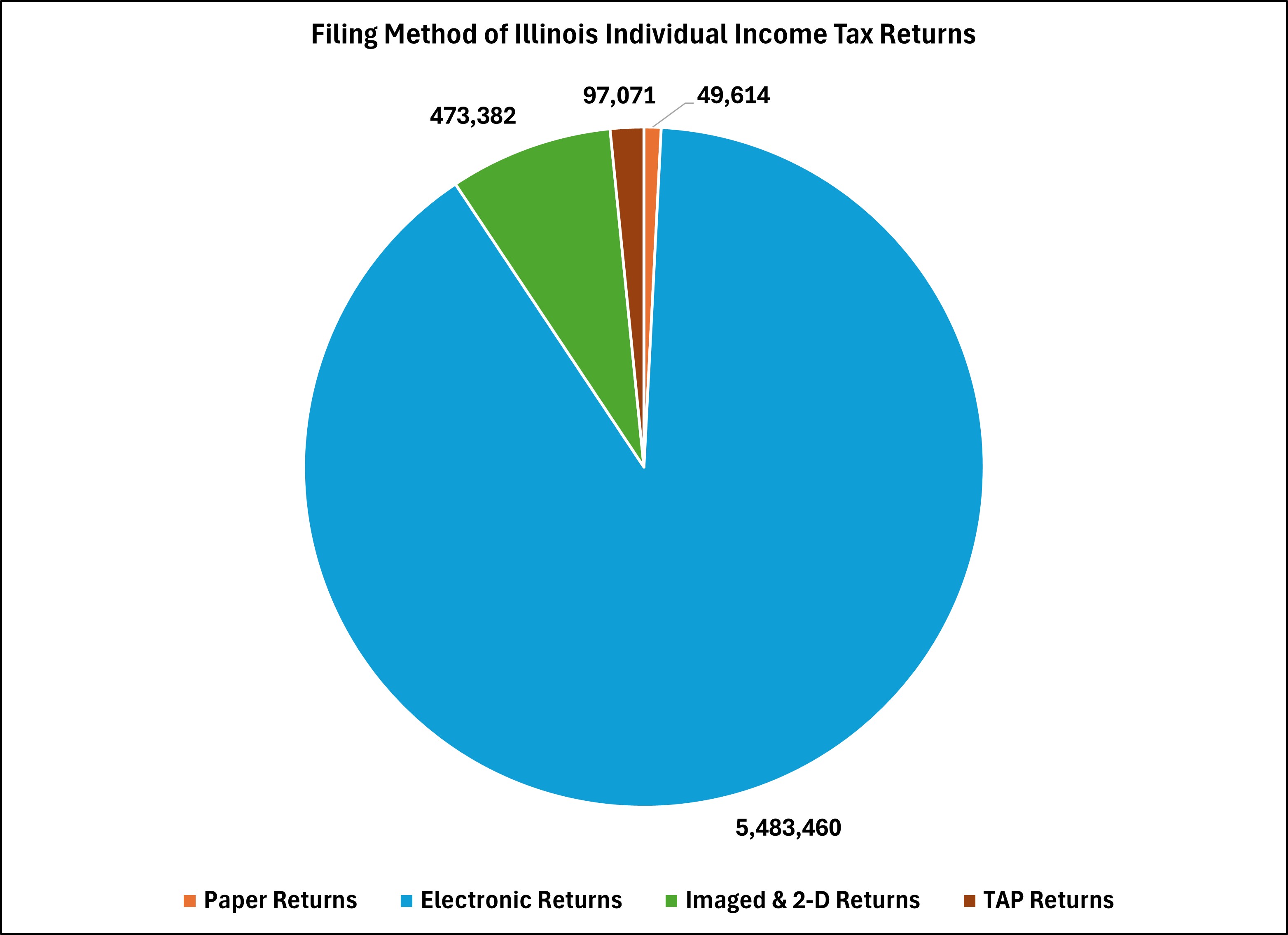

91% of individual income tax returns are filed with the Illinois Department of Revenue electronically. This includes any electronically filed return, whether an individual used tax preparation software or a tax preparer filed the return electronically. There are thirteen software vendors approved by the Department to file returns electronically.

The next most popular filing method is imaged or 2-D returns. These are paper returns that have a barcode or other similar mark on the front page of the return that contains all the information in the return. This allows the Department to scan the barcode or other mark and easily digitize the entire return rather than having employees perform data entry line by line.

Almost 100,000 taxpayers used TAP returns. TAP returns are returns that are filed electronically using the Department’s own portal, MyTax Illinois. The least popular filing method is a paper return without a 2-D barcode, with just under 50,000 taxpayers filing this way. This is the most labor-intensive filing method for the Department as they have to enter the return into a computer. Each year, fewer returns are filed this way.

Source: Illinois Department of Revenue

Source: Illinois Department of Revenue

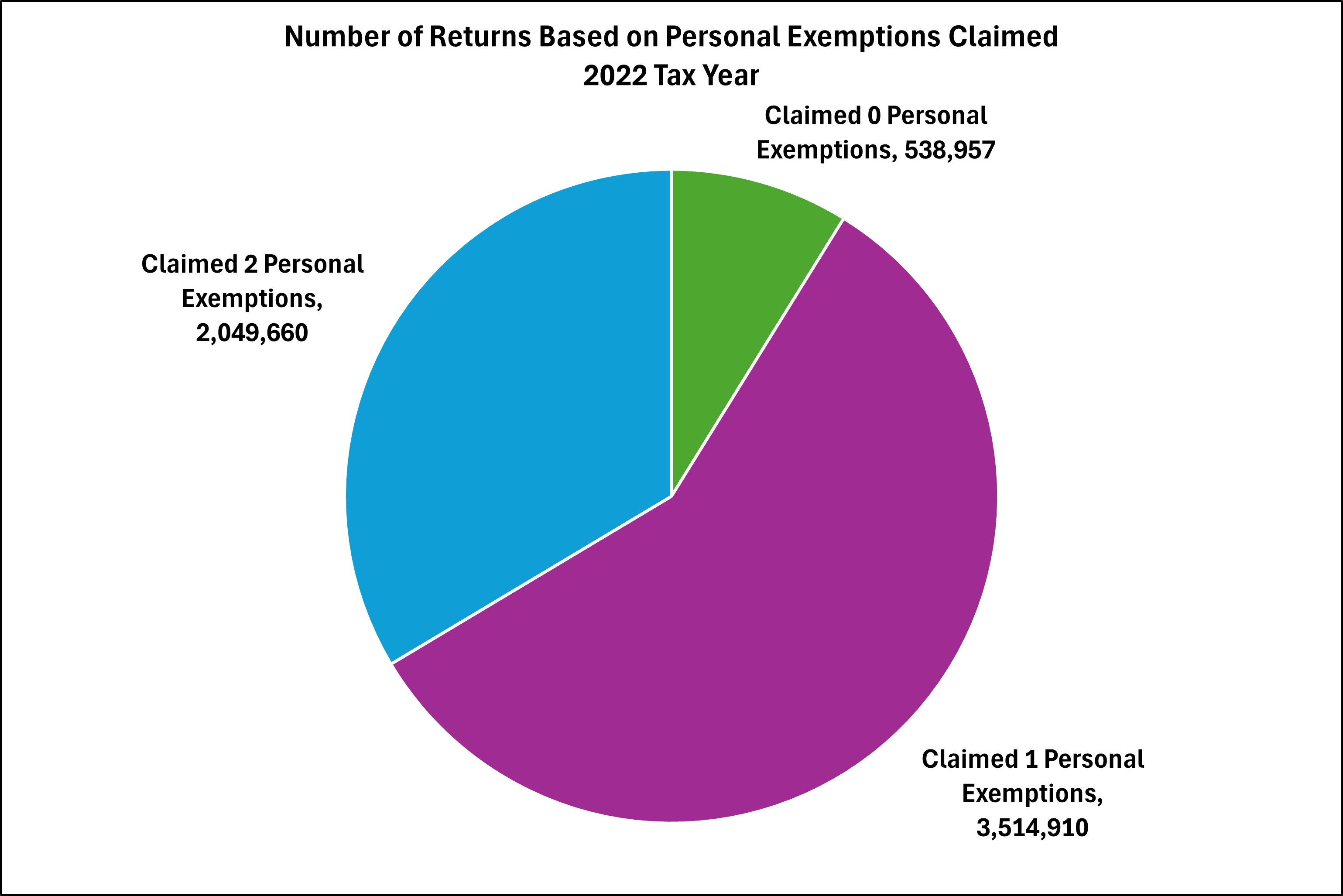

When filing your income tax return, you generally claim yourself and your spouse as a personal exemption. You are not allowed to claim a personal exemption if someone else claims you as a dependent or if your adjusted gross income exceeds $250,000 (single) or $500,000 (married filing jointly). 58% of taxpayers claimed only a single exemption, and 34% claimed their spouse and themself. Although not reflected on the chart (because claimants fell into all 3 categories), there are additional exemptions for those over 65 years old or older and 20% of taxpayers claimed this exemption.

Source: Illinois Department of Revenue

Source: Illinois Department of Revenue

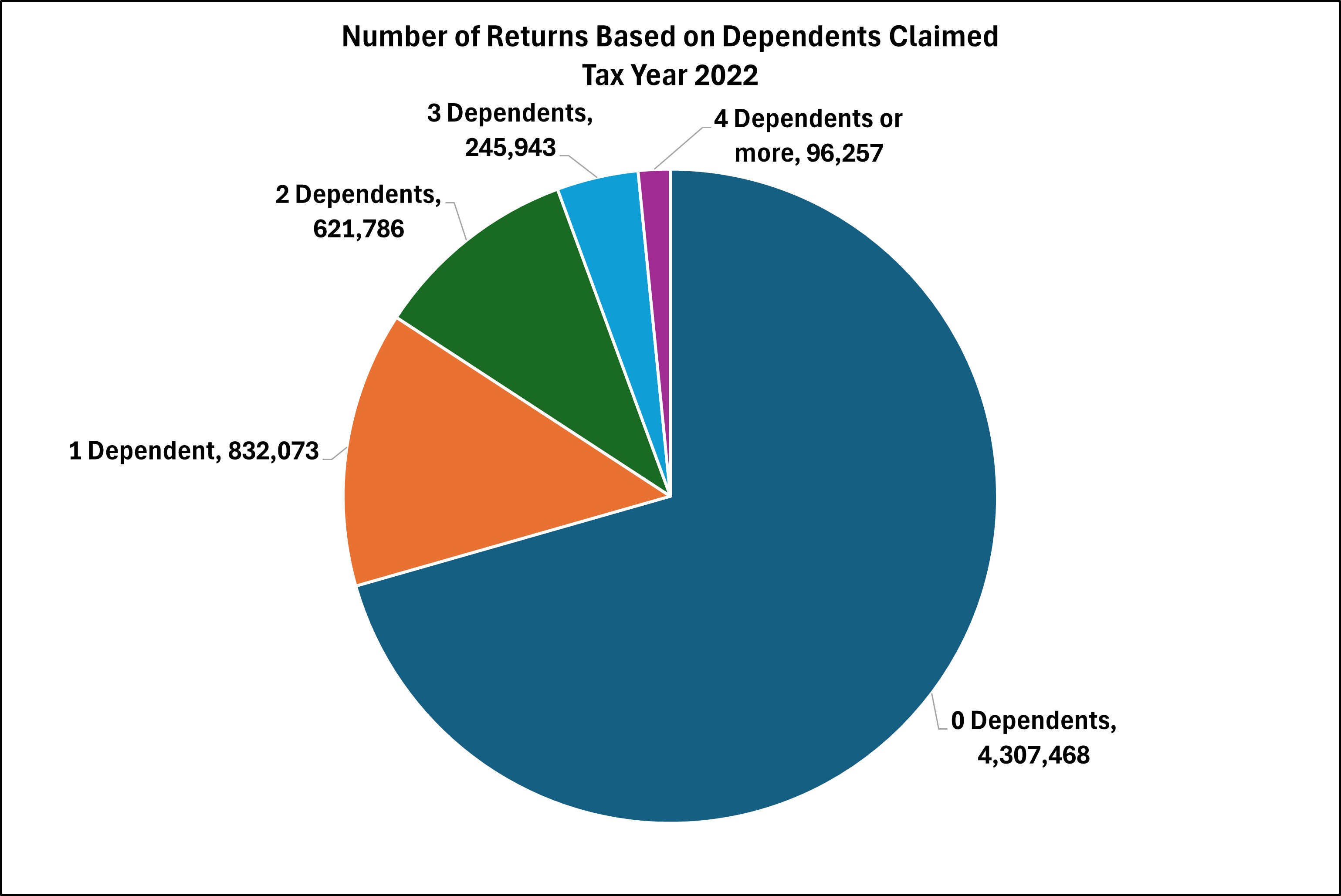

Besides exemptions for your spouse and yourself, you are allowed exemptions for any dependents, although single individuals with an adjusted gross income of more than $250,000 or couples earning more than $500,000 are not eligible. 71% of taxpayers did not claim an exemption for a dependent. Interestingly, two taxpayers claimed 15 dependents or more.

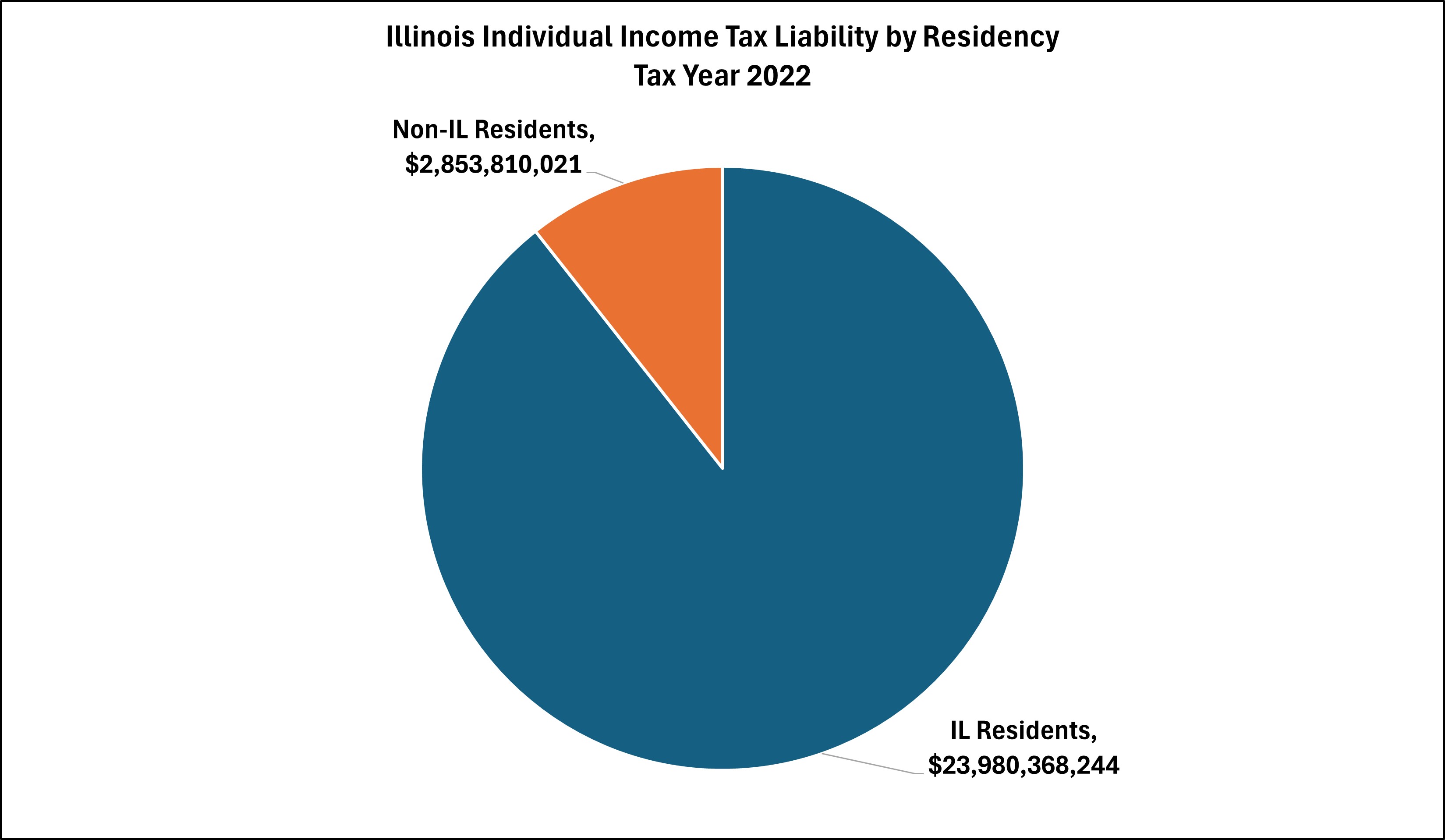

Not all Illinois taxpayers live in Illinois; residents of other states (and other countries, for that matter) also pay Illinois income tax. Slightly over 10% of the individual income tax revenue in 2022 was collected from out-of-state residents.

Source: Illinois Department of Revenue

Source: Illinois Department of Revenue

Who are these people? There are generally two ways a nonresident individual could owe tax: if they earn money while working here (although, as discussed below, there are a lot of special rules), or if they own an income-producing business or asset with an Illinois presence.

Nonresidents who spend time working in Illinois can owe tax on their wages, depending on a variety of factors:

- Professional athletes (and coaches, managers, trainers, etc.). After the Chicago Bulls won their first NBA championship in 1991 over the Lakers, it was widely reported that California was taxing the Bulls’ players. While spite was the suspected motivation, the rationale was straightforward: if 6% of the team’s games were in California, 6% of the athletes’ income was earned and taxable there as well. Illinois promptly enacted a similar “jock tax” provision, sometimes called “Michael Jordan’s revenge,” taxing members of professional sports teams based on the percentage of “duty days” here.

- Residents of Iowa, Kentucky, Michigan, and Wisconsin. States occasionally enter into reciprocity agreements, so that residents of one state who work in another will only owe tax in their home state on those wages. Illinois has reciprocal agreements with Iowa, Kentucky, Michigan, and Wisconsin. (The Indiana agreement ended in 1997.)

- Disaster services personnel. Utilities and other businesses frequently deploy employees in response to disasters or other emergencies. Illinois does not tax nonresident employees on their wages for performing these services.

- Lottery winners. Winners of the Illinois lottery, or of any other state-sanctioned gambling, owe Illinois income tax on their winnings, no matter where they live.

- Everyone else. If you are a nonresident who sometimes works in Illinois, but you are not employed by a professional sports team, don’t live in one of the reciprocity states, don’t provide disaster-related services, and haven’t yet hit the Lucky Day Lotto, the “normal” rules probably apply to you. Nonresidents who work in the state for more than 30 days during the course of a year are taxed by Illinois on their wages earned while here.

And, as mentioned above, some of these nonresidents paying Illinois tax are also earning income from an asset or business with a presence here. Landlords of farmland or rental property in Illinois, for example, or an owner (whether as a partner, S corporation shareholder, or directly) of a business with an office, factory, or store here, will all owe Illinois income tax on their share of Illinois income from those assets or operations.

What Kinds of Credits and Special Exemptions Do Illinois Taxpayers Get?

We’ve taken a look at who is paying tax, and how much. We also know a fair amount about some of the tax benefits Illinois taxpayers are claiming.

Shortly after Illinois enacted its income tax, we added a deduction for nearly all types of retirement income. The IRS taxes some social security income, nearly all payments from 401k plans and IRAs, and most pensions. Most states follow the IRS on this, although a few exempt all social security or government pensions, or provide exemptions for individuals over a certain age. Illinois’ deduction is as broad as possible, covering all payments from any type of retirement-related plan to any taxpayer, costing the state $2.8 billion in fiscal year 2022, according to the Comptroller’s Tax Expenditure Report.

Source: Illinois Department of Revenue

Source: Illinois Department of Revenue

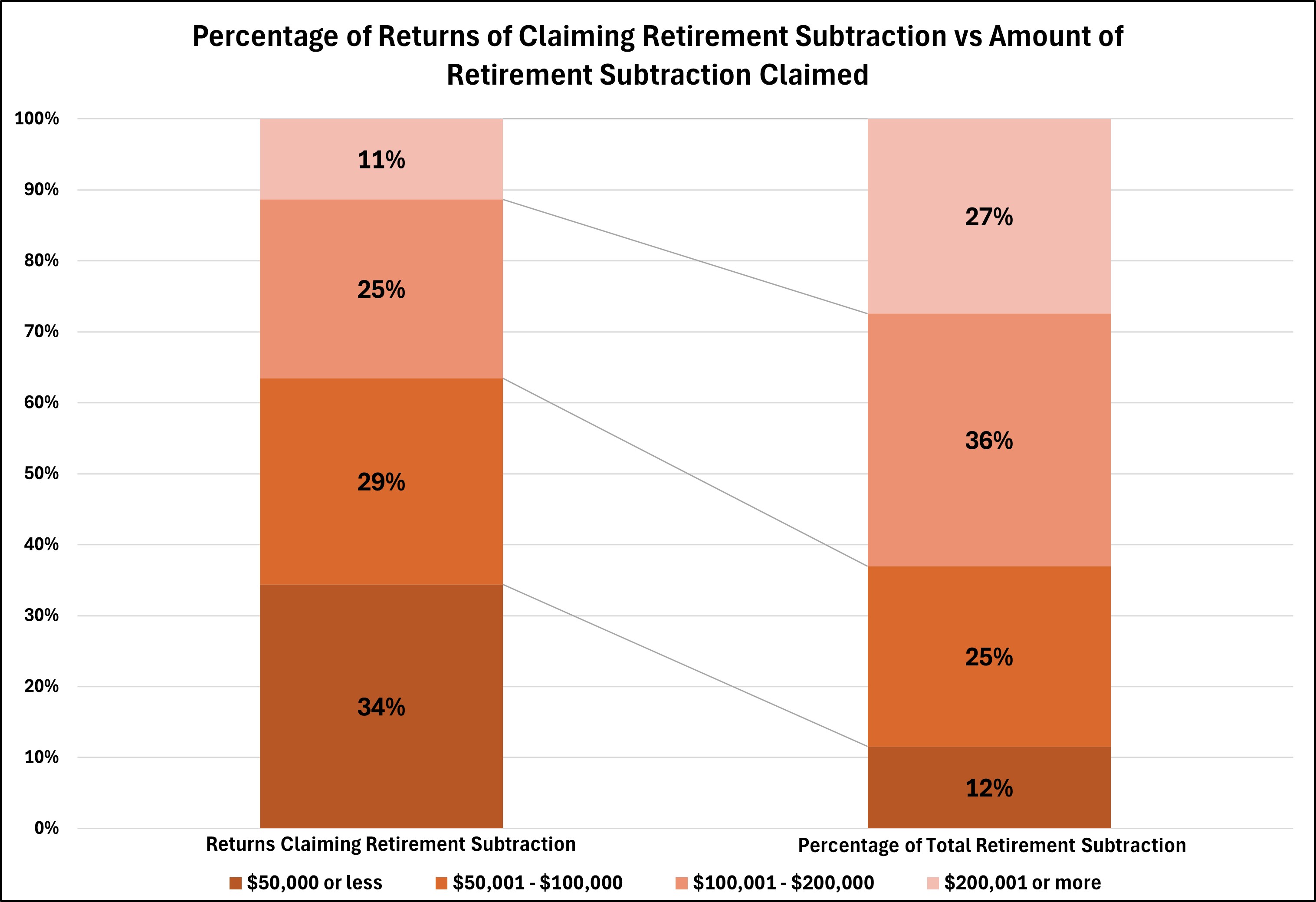

The chart above looks at one aspect of this deduction: how many of the claimants fall into various income levels, and how much of the benefit is received by those taxpayers.

Taxpayers making $50,000 or less account for over one-third of the folks claiming the retirement income exemption, but receive only 12% of the benefit. Conversely, those with income over $200,000 make up only 11% of the Illinois taxpayers subtracting retirement income from their federal tax base but receive over a quarter of the benefit. In other words, much of the cost of this tax benefit goes to those making more than $100,000.

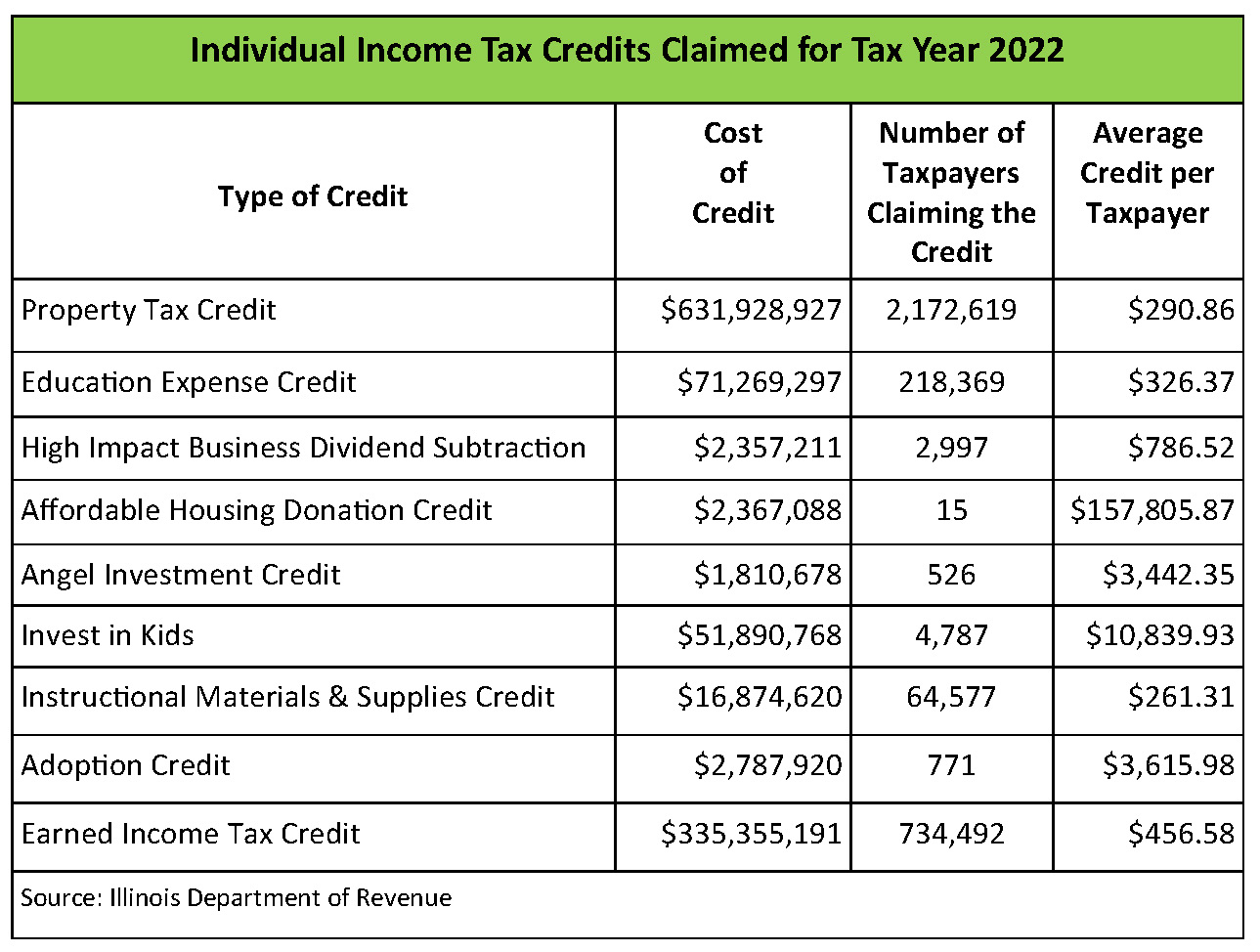

Tax Credits

The retirement income subtraction is not the only income tax benefit available to individuals in Illinois; Illinois also offers a variety of tax credits. Credits differ from exemptions or deductions in that credits are dollar-for-dollar offsets against the tax liability, while deductions and exemptions reduce the amount of income subject to tax.

Each credit has specific requirements and limitations, and each was enacted with a specific purpose in mind. Some, like the instructional materials and supplies credit and the adoption credit, are relatively new, and the Invest in Kids program was not renewed after 2023. The largest three—the property tax credit, the earned income tax credit, and the education expense credit—are not available to high-income taxpayers.

In total, the income tax credits available to individuals in Illinois represent over $1 billion in reduced tax revenue to the State.