TFI Tax Facts (77.2): How Much Illinois Income Tax is Directly Attributable to Businesses?

TFI Tax Facts: How Much Illinois Income Tax is Directly Attributable to Businesses?

February 2024 (77.2)

When we published our Business Income Tax Primer in June, we promised to move beyond the legal and policy examination and follow up with a calculation of how much Illinois businesses contribute to state income tax collections. Like all things tax, the answer is not simple and straightforward, all the more so because it takes more than a year to identify which types of income taxes have been collected. In this article, we attempt to quantify Illinois income tax collections attributable to businesses, and we will also look at tax incentives and credits for businesses (inaccurately called “corporate loopholes” in the parlance of the times) in Illinois.

Income Taxes Attributable to Business

For the purposes of this research, we are going to consider only income taxes directly attributable to a business and will ignore, for example, tax on dividends that a corporation pays to its investors. In so doing we look only at the legal incidence of the tax, not the economic incidence which is split among customers, employees, and owners. See “Legal vs Economic Incidence,” Tax Facts, March 2021. And we will look only at gross tax revenue, not considering money set aside for or paid as refunds.

Historically, the Illinois Income Tax Act effectively imposed three income-based taxes, and business activity directly accounted for a portion of each tax:

Corporate Income Tax (CIT) – When people think of income tax on businesses, they think “Corporate Income Tax.” C Corporations that do business in Illinois pay a 7 percent CIT on their profits earned in Illinois. A C Corporation has not made the election under Subchapter S of the Internal Revenue Code to be taxed as a pass-through entity, and is taxed under Subchapter C instead. Illinois respects the election, and the two are referred to for both state and federal tax purposes as S corporations and C corporations.

Personal Property Tax Replacement Income Tax (PPTR) – This tax was created as part of a package to replace the personal property tax on business assets (primarily machinery and equipment) that was abolished by the 1970 Illinois Constitution. It is imposed at a rate of 2.5 percent on C corporations and 1.5 percent on partnerships, S corporations and trusts. For C corporations, which account for 60 percent of PPTR, the tax pushes the total income tax rate to 9.5 percent. We classify all PPTR as directly attributable to business.

Individual Income Tax (IIT) –The share of profits that partnerships and S corporations “pass through” to their individual partners and shareholders is taxed under the individual income tax. For non-resident partners and shareholders, the pass through entity is required to withhold and remit income taxes, called Pass Through Withholding (PTW). Also attributable to business is the income of sole proprietors, typically in-home businesses or small shops that do not have a separate legal entity and report their income and expenses on the individual income tax return. Both are directly attributable to business.

A fourth tax, sort of a PPTR/IIT hybrid, was added in Tax Year 2021:

Pass Through Entity Tax (PTE) –Partnerships and S corporations can now opt to pay directly the tax their partners or shareholders would otherwise owe and pay with their individual income tax returns; the partners or shareholders may then take a credit for that tax paid on their Illinois returns. Many states have enacted similar taxes, seeking to sidestep a new federal income tax limitation on state and local tax deductions. The new PTE was signed into law in September of 2021, early in Illinois FY 2022.

The Department of Revenue categorizes income tax receipts as either Individual Income Tax (IIT) receipts or Business Income Tax (BIT) receipts. We assume that all BIT payments – be they CIT, PPTR, PTW, or PTE – are directly attributable to business.

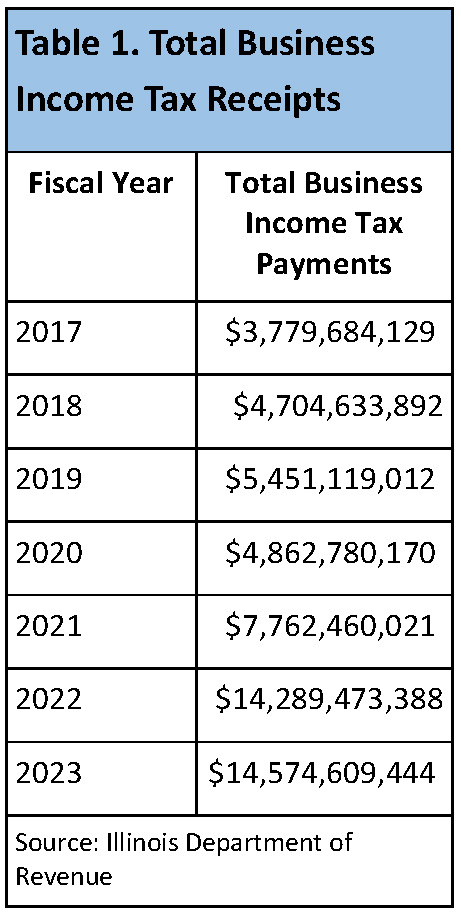

For FY 2023 the Department of Revenue collected $14.6 billion in BIT payments and $25.6 billion in IIT payments. Table 1 shows BIT gross receipts (before refunds) for the seven most recent fiscal years.

What jumps out on Table 1 is the increase in payments between FY 2021 and FY 2022. One major explanation is the new Pass Through Entity Tax; partnerships and S corporations are paying tax, instead of their partners and shareholders.

The Department of Revenue reports that for Tax Year 2021, individual taxpayers claimed PTE credits of $2.2 billion on their tax returns. That means that at least $2.2 billion was moved from the Department’s IIT system to its BIT system for Tax Year 2021 (FY 2021 and 2022). It also means the PTE saved Illinois taxpayers $550 million in federal income taxes at a conservative 25 percent federal marginal rate.

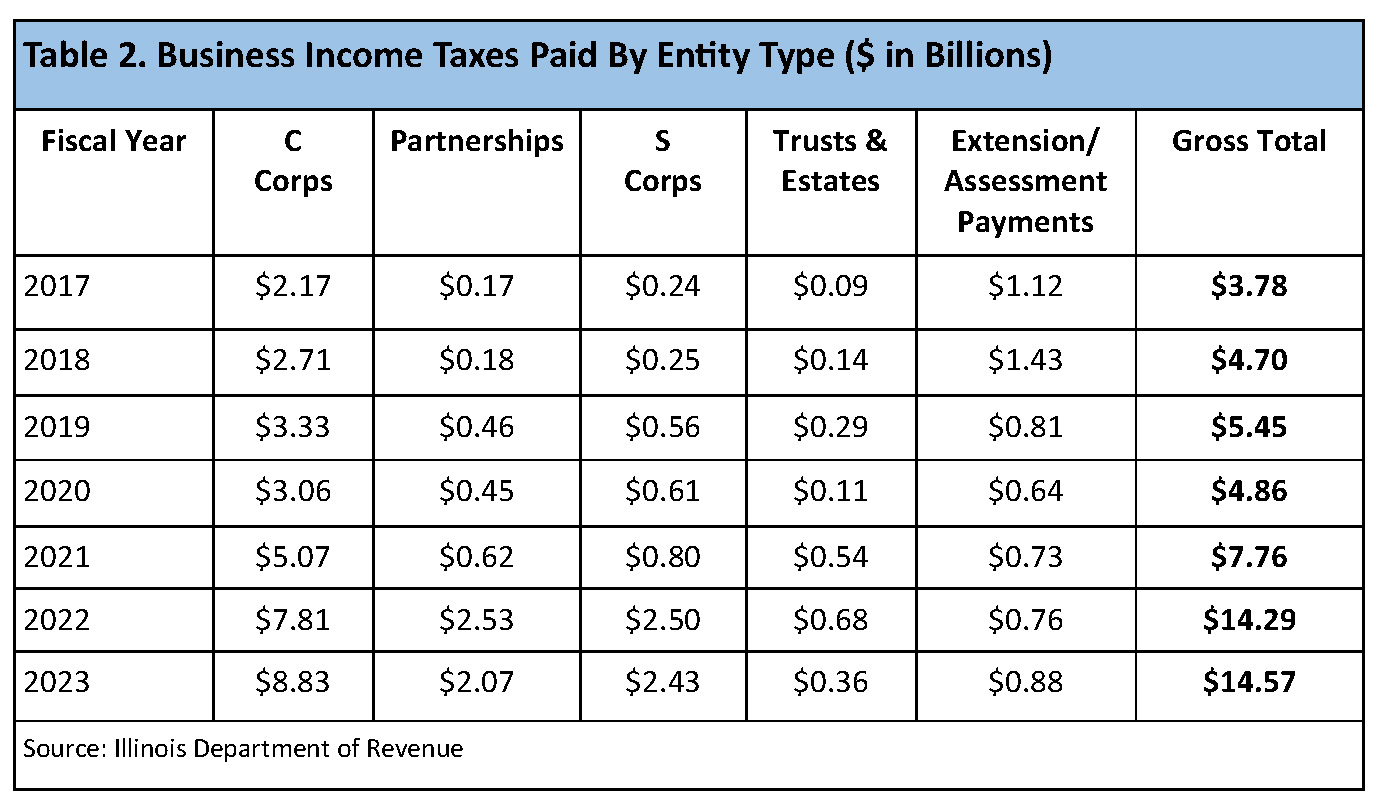

We can get further insights into the 2022 jump in BIT payments by looking at comptroller deposits, which the Department of Revenue breaks down by entity type in a monthly report. See Table 2. The big increases – more than 200 percent each – are in payments associated with partnerships and Subchapter S corporations. Again, much of this is attributable to the new PTE tax, although higher profits also contributed. For example, C Corporation receipts also rose, but at a slower rate than the pass-through entities given the PTE boost.

Business Income Tax Quantified

We need to make an adjustment to the Department of Revenue’s BIT payment total to account for sole proprietors, someone like a self-employed house painter who might not create a separate business entity but would instead include the business’s income and expenses on her/his individual income tax return. Illinois does not separately track this information, so we turn to IRS data. The most recent Statistics of Income put sole proprietor income on returns filed from Illinois at 2.3 percent of total AGI. Applying that percentage to IIT collections in FY 2023 yields approximately $600 million and would boost our estimate of income taxes directly attributable to business to $15.8 billion. That estimate may be low because it misses partners and S corporation shareholders who continue to report their income from pass through entities on their IL 1040, as they are allowed to do, if there has been no withholding or PTE election.

Total income tax payments received by the Department of Revenue in FY 2023 were $40.2 billion, making the share directly attributable to business at least 38 percent of the total.

One caveat here. In the interest of simplicity, throughout we have used gross collections, before income tax refunds are paid. One complication we have avoided is the annual reconciliation of the Refund Fund, which resulted in a $555 million transfer into the General Revenue Fund in FY 2023, significant but less than the $1.5 billion transfer made in FY 2022. Also note that a higher percentage of BIT collections are used to pay refunds than IIT collections, so the share of income tax directly attributable to business could be slightly different if we used net numbers.

Business Income Tax “Loopholes”

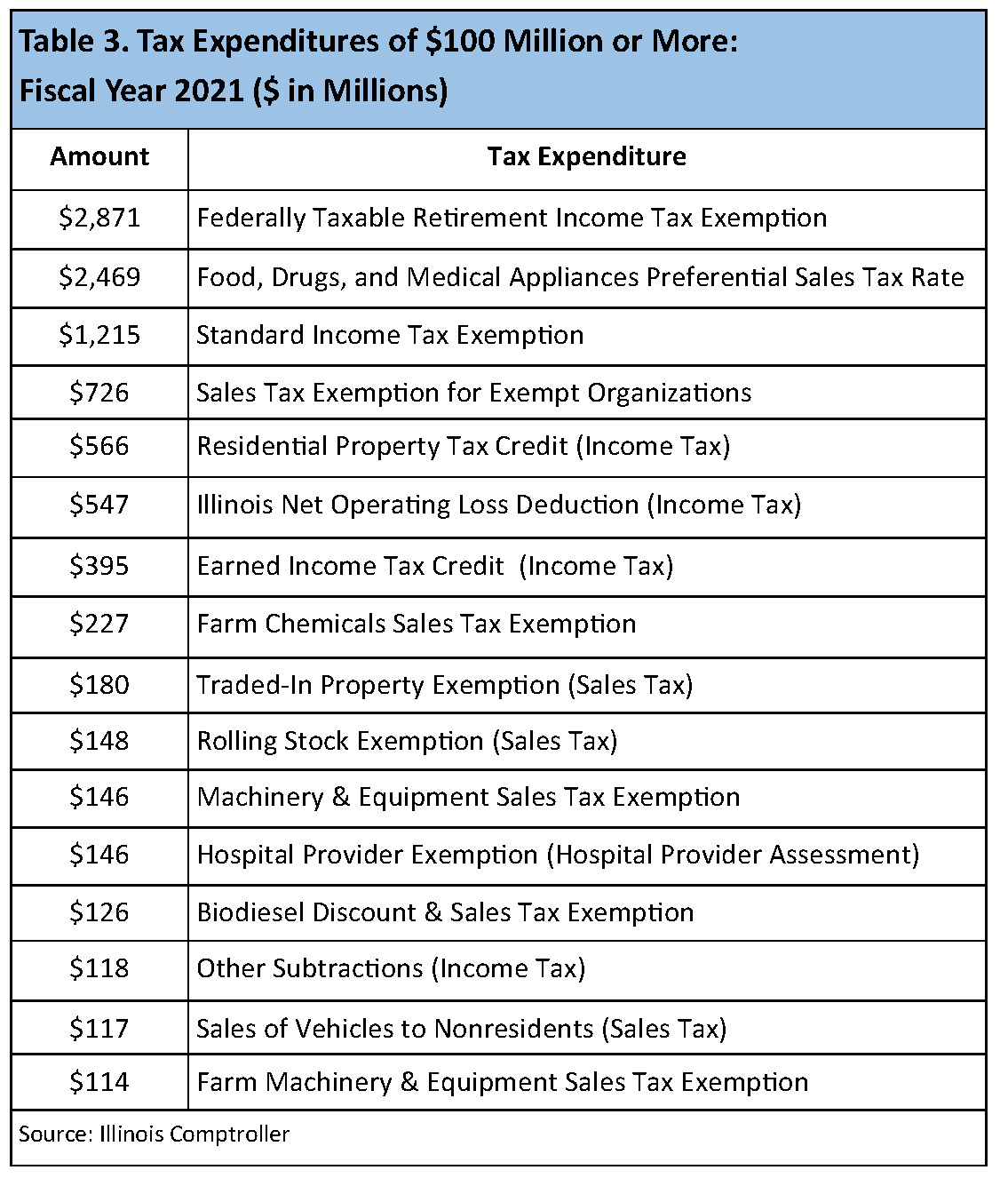

An attempt to quantify business’s contribution to Illinois income tax receipts should also address what are routinely called “corporate income tax loopholes,” a concept which gets brought up anytime someone believes the government needs money. In reality, tax breaks are found in all of the taxes imposed by Illinois, not just the corporate income tax. And although there are numerous deductions and credits available to businesses and they all deserve scrutiny, they are not as extensive as other breaks, and many are in place to improve tax fairness, rather than to simply give business an advantage.

The technical term for credits, exemptions, deductions and the like is “tax expenditures,” and the Illinois Comptroller tracks them. The latest Tax Expenditure Report is for 2021 and enumerates all tax expenditures over $100 million (accounting for 90 percent of all Illinois’ tax expenditures). See Table 3. The big ones are the retirement income subtraction and the standard exemption on the individual income tax return and the food and drug exemption in sales tax. The only business income tax expenditure on the list is the state net operating loss deduction, accounting for most of the $887 million in corporate income tax expenditures. See the October 2021 issue of Tax Facts for a discussion of the need for and importance of net operating loss deductions in an equitably structured business income tax.

Conclusions

From the data available to us we can conclude that in FY 2023 more than 38 percent of income tax collections were directly attributable to businesses, including Corporate Income Tax, Personal Property Tax Replacement Income Tax, Pass Through Withholding on non-resident partners and shareholders, and the Pass Through Entity Tax.

In putting together the data for this piece, a couple of other facts jumped out. First, C corporations were responsible for nearly two thirds of business income taxes in FY 2023, despite the growth in recent years of other legal forms of doing business. Second, most of the cost to state revenues from tax expenditures comes from tax breaks benefitting individual taxpayers, not from “corporate tax loopholes.”

Tax Year 2021 Belated Surprise, in 2023

When the Tax Year 2021 returns were finalized in March of 2023, it caused a stir. PPTR, which had been assumed to be $5.2 billion (and had already been distributed to local governments), turned out to be $4.4 billion. Similarly, Corporate Income Tax, which was assumed to have been $7.5 billion, ended up being $7.3 billion. However, Individual Income Tax from pass through entities, which had been deposited as $2.5 billion, turned out to be $3.6 billion. There was no change in total collections, and for our purposes all collections remained directly attributable to business. The difference was what type of tax it was. That matters because different taxes are distributed differently.

The surprise was a welcome one for Illinois state government, which receives most Individual Income Tax receipts. For local governments, which get most of the PPTR, the surprise was unwelcome. As required by law, the estimated PPTR revenue had been distributed to local governments immediately. As a result of the 2023 surprise, FY 2024 PPTR distributions to locals have dropped and overpayments are being recovered in five installments that began in September, resulting in a double whammy to their cash flow. Replacement tax distributions are estimated to fall $1.3 billion (28 percent) in FY 2024, from $4.5 billion to $3.2 billion.

By the time these adjustments for Tax Year 2021 were calculated and finalized, allocations using the prior formula had been made for all of FY 2023, meaning another significant adjustment will likely be needed in FY 2025.

The culprit that caused the big change was the Pass Through Entity Tax. Partnerships and Subchapter S Corporations remitting tax for their partners and shareholders boosted total payments, but the Department of Revenue allocated money based on historical patterns from before the PTE was enacted.