Tax Facts: An Illinois Chartbook – How Does Illinois Compare?

Tax Facts: An Illinois Chartbook

How Does Illinois Compare?

February 2023 (76.2)

People frequently ask how taxes in Illinois compare to those in other states. The story of six blind men who each touched an elephant comes to mind. In the story, each of the men touched a different part of the elephant: the side, the trunk, a tusk, a leg, an ear, and the tail. Each of the men had very different experiences based on the part they touched. An accurate picture of the elephant was possible only if the men put their experiences together. Similarly, there isn’t a single chart or figure that completely encompasses taxes in Illinois.

In this article, and throughout the series of articles we are publishing this year comparing Illinois taxes to other states, we will provide different views of Illinois taxes to portray a more complete view of taxes in Illinois. A couple of notes on the data we use, before we begin:

- To provide an accurate picture we look at state and local taxes combined. Some states pay for services with state funds, while others leave that funding to local governments and local taxes. Furthermore, a person buying $100 worth of groceries and other household goods usually does not know (or care) who imposed the sales tax on those goods, and which government receives the tax.

- Secondly, tax collection rankings should reflect the states’ differing economies (which often reflect different costs of living and income levels). For example, let’s assume States A and B both have a flat income tax rate of 5%, but in State A the median personal income is $50,000, and in State B the median personal income is $55,000. As a result, the median State A resident would pay $2,500 in income taxes and the median State B resident would pay $2,750. Even though the two states have the same rate, the State B resident pays more in absolute dollars, but she also has more after-tax income. Does State B have higher taxes, or are they equal? We would posit that they are equal, but under a per capita comparison, B’s taxes are higher. To avoid this distortion, we look at taxes as a percentage of gross state product (the total value of all goods and services produced within the State) to arrive at the percentage of economic output diverted to taxes, rather than per capita taxes, for our comparisons.

- We use the most recent data released by the Census Bureau, which is for FY 2020 (July 1, 2019 – June 30, 2020). This is the first fiscal year affected by COVID-19, which has had a significant impact on everything, including state and local taxes, although the impact was larger in later years. We will update these charts when the Census Bureau releases updated data.

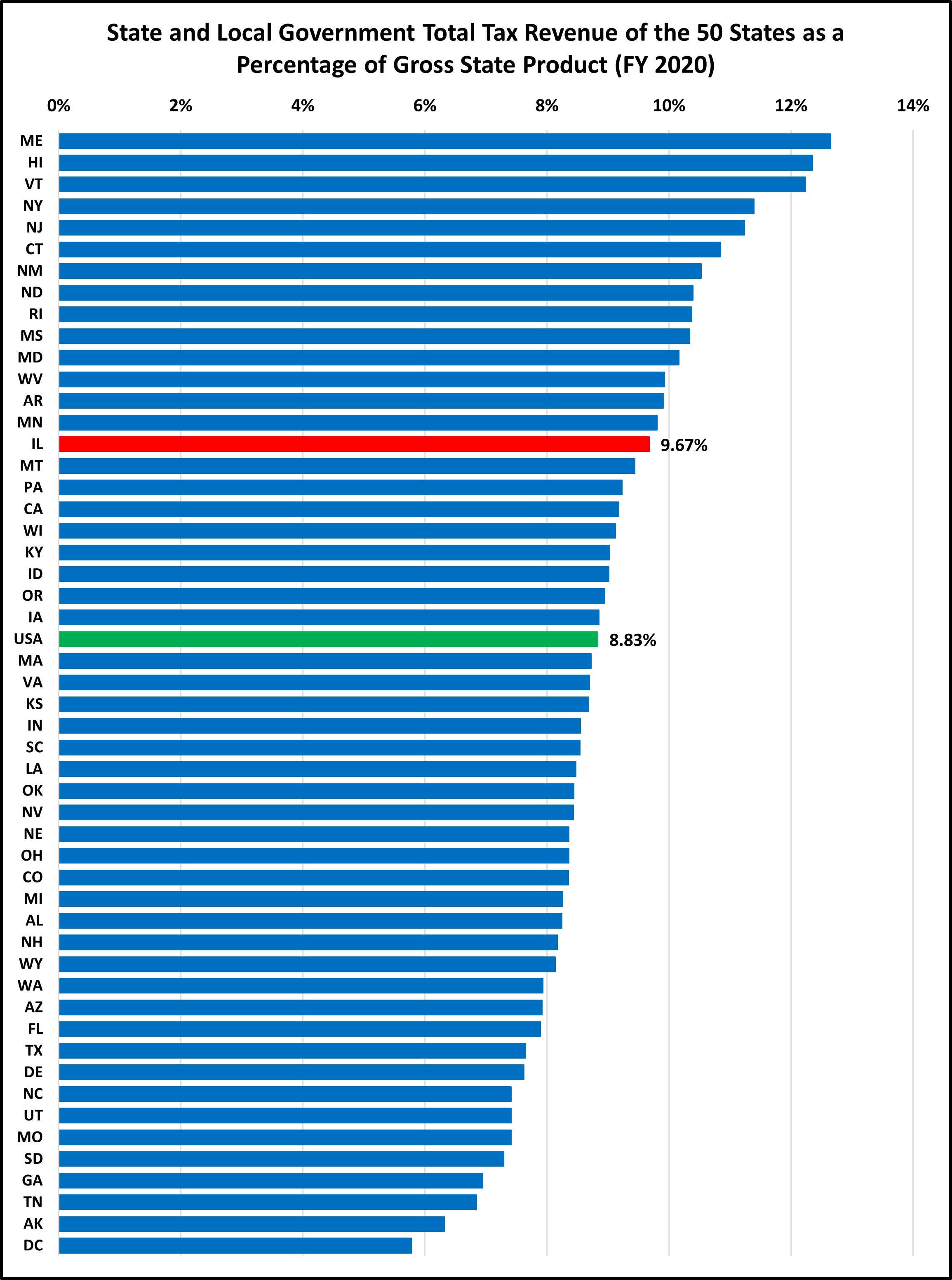

ILLINOIS TAXES ARE ABOVE AVERAGE

Source: Census Bureau, State and Local Government Finances and Bureau of Economic Analysis

In FY2020, Illinois had the 15th highest total tax collections at 9.67% of gross state product. In total, Illinois state and local governments collected $84.0 billion in taxes, which is $7.3 billion more than would have been collected had Illinois been at the national average.

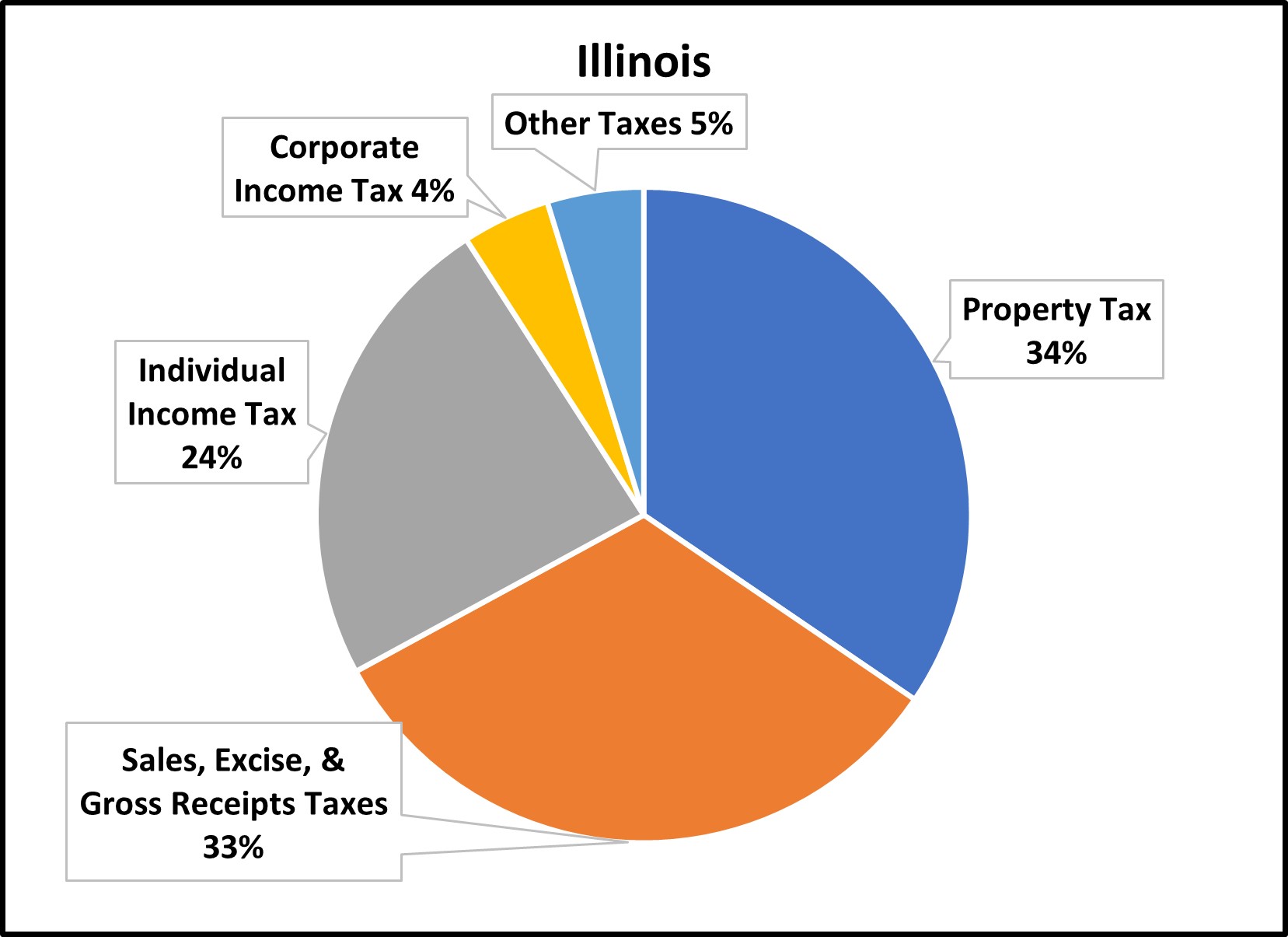

THE MAKEUP OF ILLINOIS’ TAX SYSTEM IS FAIRLY TYPICAL

Source: Census Bureau, State and Local Government Finances

These charts show the extent to which Illinois relies on certain taxes compared to the national average. Overall, the relative makeup of Illinois’ total tax collections is fairly typical. Illinois relies on property taxes more so than the average state, which shouldn’t be too much of a surprise to Illinois residents. Conversely, Illinois relies less on sales, excise, and gross receipts taxes than the average state. States that do not impose an income or sales tax would naturally have very different looking charts.

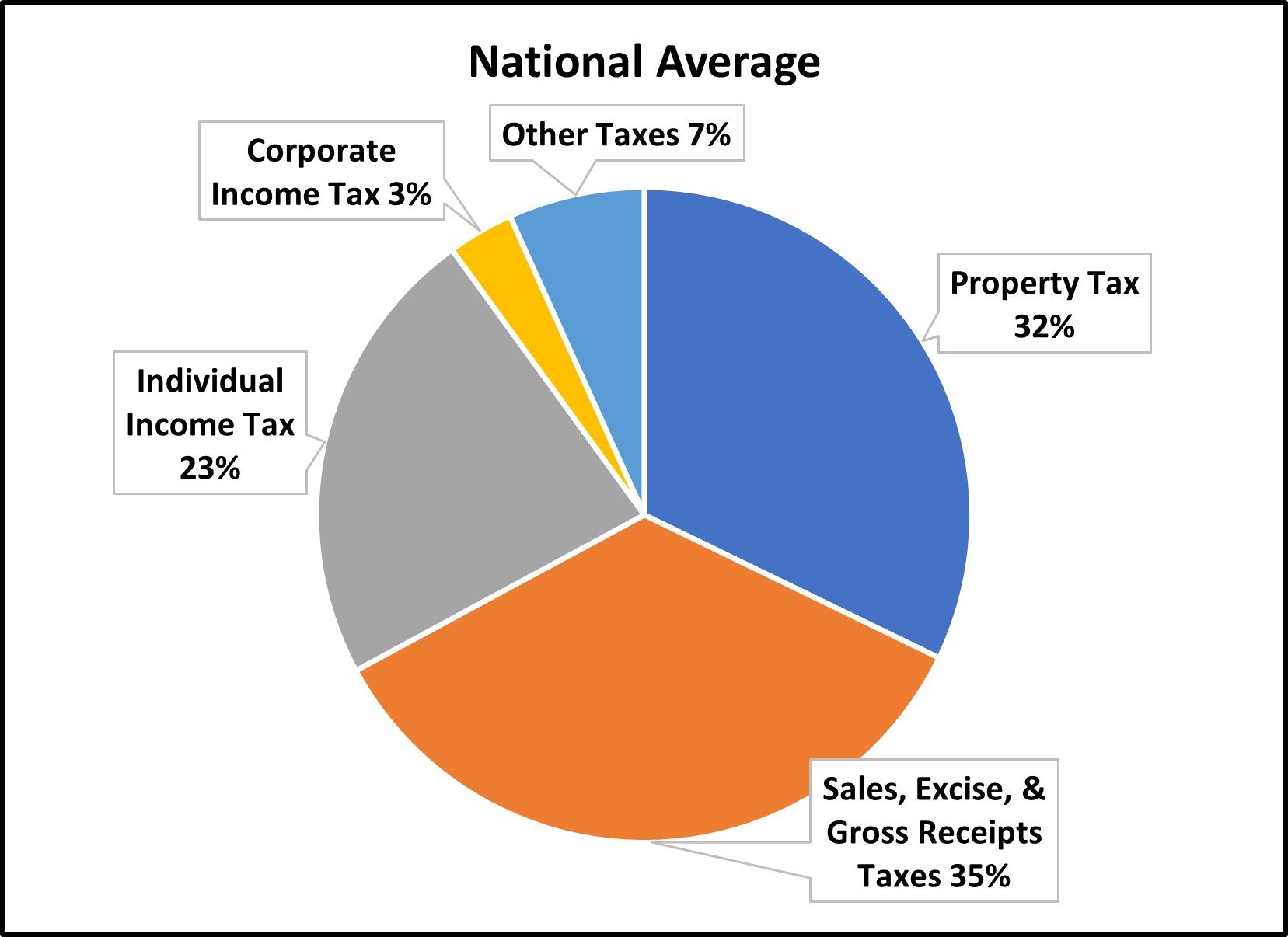

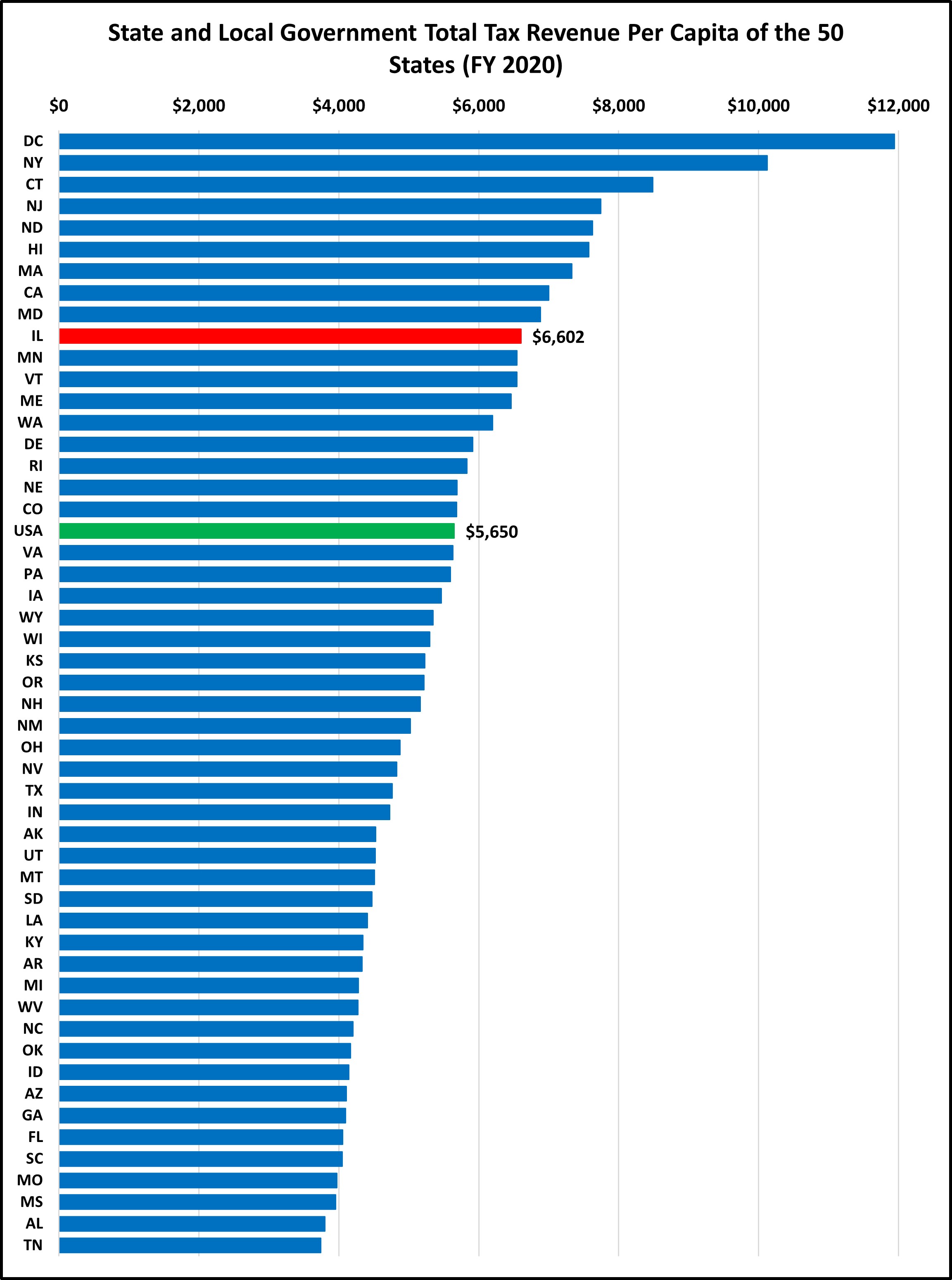

PER CAPITA TAXES IN ILLINOIS ARE HIGH

Source: Census Bureau, State and Local Government Finances

Although per capita measurements fail to consider the states’ different economies, they still have a purpose. When we say Illinois’ state and local taxes are 9.67% of gross state product, most people will gloss over the figure as it’s essentially a foreign language. Saying that Illinois’ state and local tax burden is $6,602 per person, on the other hand, is easier to understand (even though few people would pay this exact amount). The national average per capita state and local tax collection is $5,650.

Different numbers looking at the same thing – taxes in Illinois – can paint different pictures. Illinois collects more state and local taxes than average as a percentage of gross state product and on a per capita basis, but under one measurement (gross state product) Illinois is 9.5% above average, while under the other (per capita) Illinois is 16.8% above average. This is a significant difference: using per capita figures, Illinois’ taxes are $12.1 billion above average, but only $7.3 billion above average using the gross state product comparison.

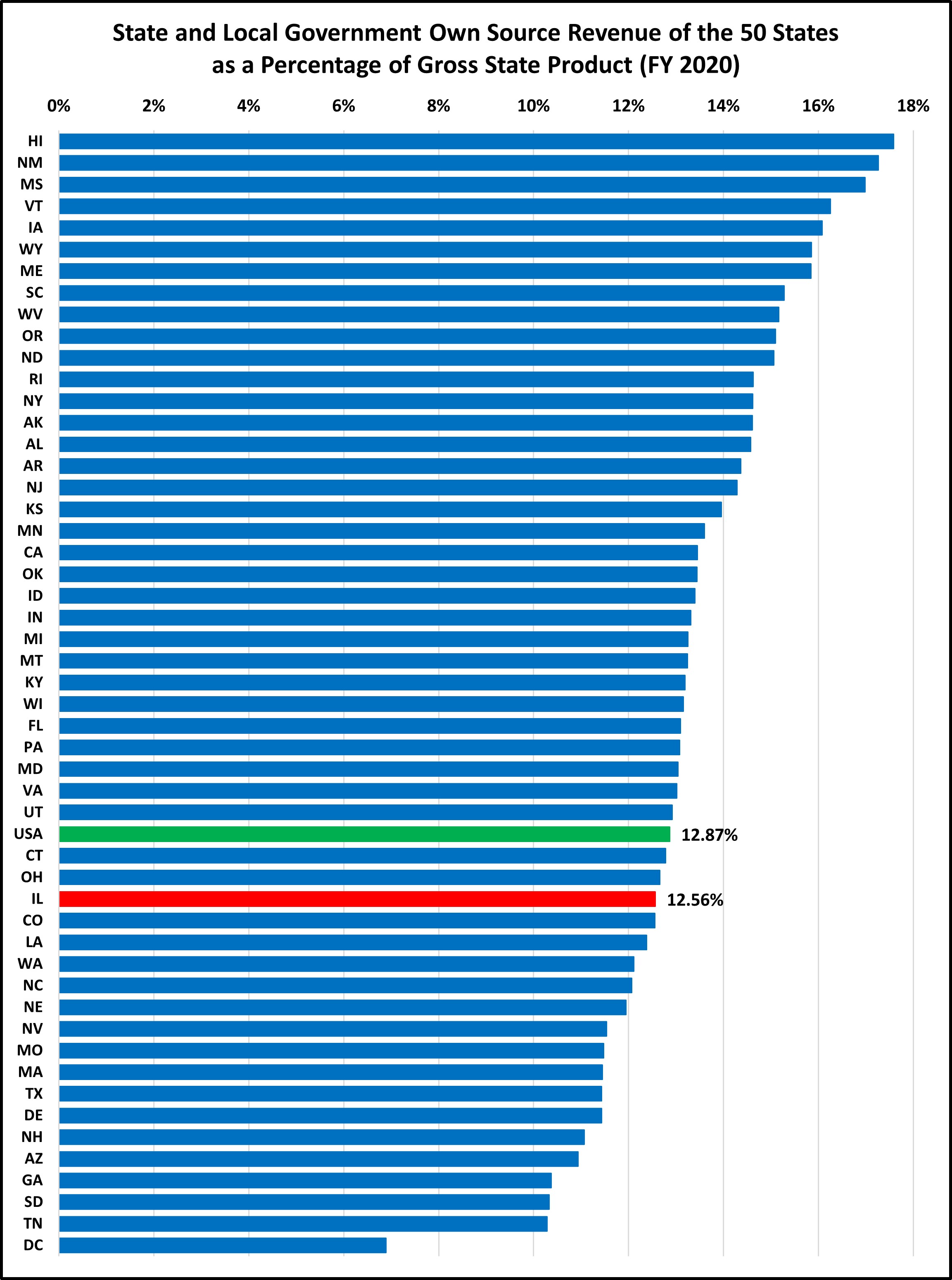

ILLINOIS OWN SOURCE REVENUES TELL A DIFFERENT STORY

Source: Census Bureau, State and Local Government Finances and Bureau of Economic Analysis

So far, we have compared total tax collections in Illinois (which includes income, sales, property, excise, utility, and other miscellaneous taxes) to collections in other states. We have not looked at other revenues that state and local governments receive, such as fines, fees, college tuition, tolls, and other similar revenues. One can argue that a more inclusive figure, that includes taxes and fees, (the U.S. Census uses the term own-source revenue) is a better measuring stick, since a person doesn’t care if a payment they make to a government is a fee or a tax–it is still going to the government. However, most fees are for a specified service (or should be), such as students paying tuition to attend a state university or a driver paying a highway toll. And the revenues from these fees are generally used to fund that specific service (the university or highway), rather than for general government purposes. Even so, it can be useful to look at this more inclusive figure, which shows that Illinois is below the national average.

Tax revenues are above average, according to the previous charts, but total own-source revenues are below average, which seems contradictory. What is driving this difference? Own source revenue does not include revenues from government run utilities and liquor stores, but it does include revenues from government run hospitals. Illinois’ state and local governments collect only $176 per capita from government run hospitals while the national average is $570 per capita. Nationally, 19% of hospitals are run by state and local governments. In Illinois, that figure is 13%, which explains why we collect a below average amount. If Illinois were at the national average, we would collect an additional $5.0 billion in hospital revenue. However, governments that collect hospital revenue need to provide medical care in exchange for those payments. If Illinois wanted to increase the hospital revenue figure, our state and local governments would also have to increase the number of, and amount of expenditures on, government hospitals. Increasing hospital revenues would not guarantee any additional funding for other state functions or otherwise alleviate Illinois’ tax burden.

While this own-source revenue comparison may be useful for some purposes, understanding it requires looking at what is driving the difference: where is Illinois significantly below average, and where are we significantly above average. In this case, Illinois’ below average ranking is mainly due to fewer government operated hospitals in Illinois.

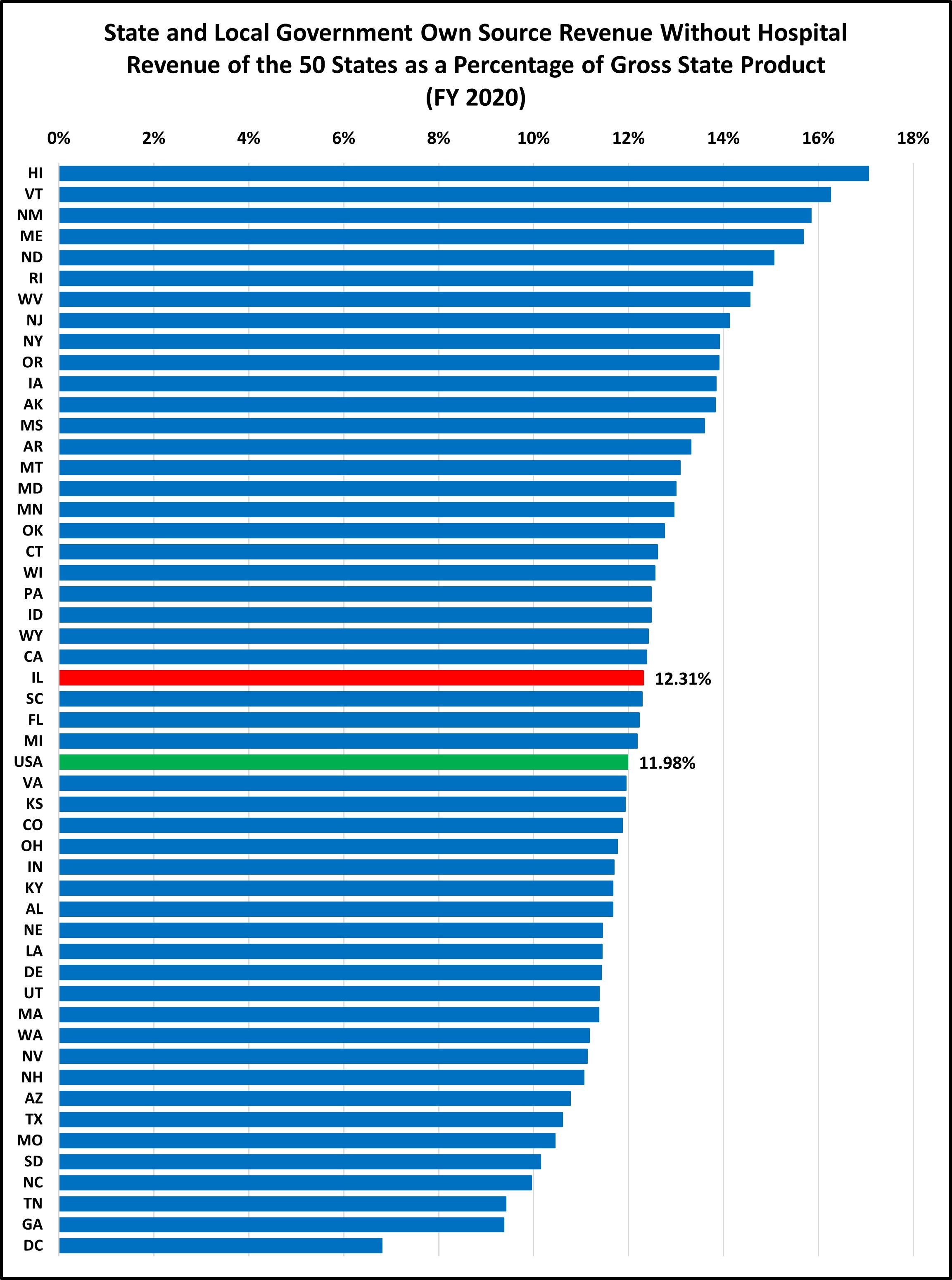

REMOVING HOSPITAL REVENUE RAISES ILLINOIS RANKING

Source: Census Bureau, State and Local Government Finances and Bureau of Economic Analysis

When government hospital revenue is removed from the own-source revenue data, Illinois’ ranking increases. Illinois went from below average to slightly above average, meaning Illinois is not much of an outlier after all.

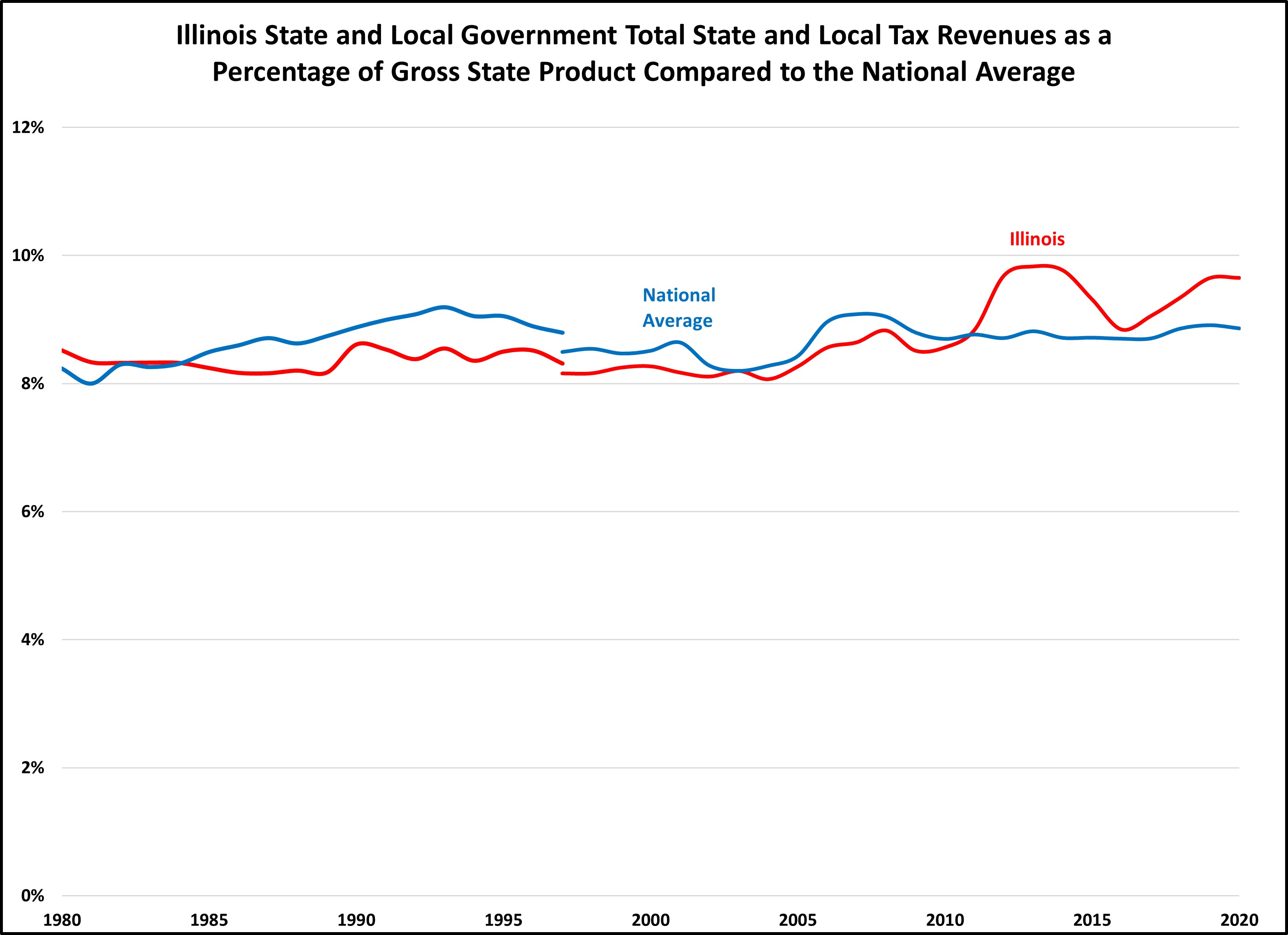

UNTIL RECENTLY, ILLINOIS TAXES HAVE BEEN BELOW AVERAGE

Source: Census Bureau, State and Local Government Finances and Bureau of Economic Analysis

Historically, Illinois’ total state and local tax collections as a percentage of gross state product has been slightly below the national average. Taxes in Illinois increased in 2011 when income tax rates temporarily increased and came down when the income tax rate increase expired. In mid-2017, income tax rates were increased again, and the chart reflects the resulting changes in tax collections.

CONCLUSION

Are taxes in Illinois high? The answer is complicated, as is often the case when you ask a tax-related question.

When you look at the overall state and local tax burden, as we have done in this article, taxes in Illinois are above the national average, using most measuring sticks. For those who believe taxes are too high, this shows that there is definite room for improvement. On the other hand, they aren’t the highest in the nation, and for those who seek additional government spending for various projects, this shows capacity to raise taxes instead. Holders of these differing viewpoints may not be blind, but they frequently choose to look at things from a singular perspective, much like the blind men in our opening story.

In future issues of Tax Facts, we will take a deeper dive and show how Illinois compares to the rest of the country focusing on specific tax types: income, sales, and property taxes. And we will continue to present a variety of ways to answer the question: are taxes in Illinois high?

METHODOLOGY

Charts like these are only as good as the underlying data. We consistently rely on data from the United States Census Bureau, specifically, the Annual Survey of State and Local Finances. Some states have taxes which do not fit neatly into a category, such as Washington’s Business and Operations Tax, a gross receipts tax on businesses. Some might think it should be classified as a corporate income tax. However, the census classifies it as a sales and excise tax. There are other instances where the Census guidelines and classifications may not be intuitive, but for simplicity and consistency, we follow the Census classifications.

We are aware of flaws in the Census data. The sales tax data for Illinois was incorrect for approximately twenty years. Recently, there has been a mistake with Illinois’ individual and corporate income tax data. We use corporate and individual income tax data from the Illinois Comptroller until the issue with the U.S. Census is resolved.

Additionally, the Census did not perform the State and Local Government Survey in 2001 and 2003 so data is unavailable for those years.

Despite these faults with the Census data, it is the best data source that exists to compare state and local government taxes.

Data from the Illinois Department of Revenue was obtained from their website or through a Freedom of Information request.

In 1997, the U.S. Bureau of Economic Analysis changed how gross domestic product and gross state product were calculated, resulting in a slightly higher value and causing a break in the historical chart above.