Illinois’ Sales Tax Through A Policy Lens

Illinois’ Sales Tax Through A Policy Lens

April 2021 (74.3)

by Carol Portman*

What is a Sales Tax, and What Should be Taxed?

Illinois is one of the 46 states (along with the District of Columbia) that impose a state-wide sales tax. In Illinois, the tax is technically the “Retailers’ Occupation Tax”, and there are some odd and antiquated features of our tax regime as a result, but it is the functional equivalent of a sales tax (along with more than a score of related but separately enacted taxes, like the Use Tax).

Tax policy tells us that a well-designed sales tax is imposed on only the final consumption of goods (or services, but more on that later). Intermediate steps along the way should not be taxed. Otherwise, tax pyramiding occurs, and with it a number of problematic consequences.

Pyramiding

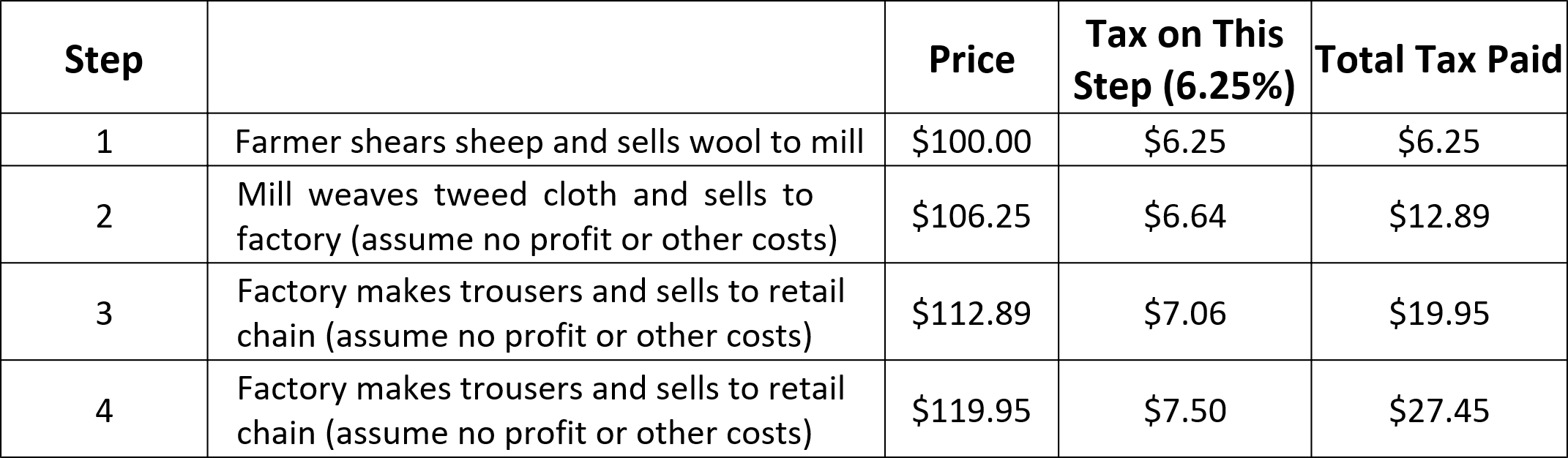

The term “tax pyramiding” is used to describe the phenomenon when multiple steps in the chain of commerce are taxed, resulting in layers of tax on what is fundamentally the same thing. A simple example illustrates how this can happen, and the cost:

If tax is applied to each step along the way, the 6.25% tax on a $100 item ends up costing $27.45. In the real world, of course, things are more complicated. For example, the factory purchases thread, buttons and zippers which become part of the trousers, and also purchases machinery and equipment to cut and sew the trousers, supplies necessary to keep the machines operating, and even chairs and desks for its employees to use while designing the trousers and operating the machines. The cost of these purchases are incorporated into the selling price of the trousers, just like the cost of the wool. To the extent those purchases are subjected to tax, there is additional tax pyramiding.

The problems with pyramiding

Multiple taxation occurs. The most obvious consequence of tax pyramiding is that the same underlying good—in our example, a pile of lambs’ wool—is taxed multiple times. Illinois has set the state tax rate at 6.25%, but $100 worth of wool in our oversimplified example triggers $27.45 in tax. There are several other side effects of pyramiding, less obvious but still troubling:

The true tax burden on the consumer is hidden. A customer purchasing our trousers from the retailer for $119.95 sees only the $7.50 in tax added at the final step, not realizing that there is another $19.95 of tax buried in the purchase price. One of the principles of good tax policy is transparency—taxpayers should know how much tax they are paying.

Small businesses are at a disadvantage. In our example, there are only 4 steps from the farmer to the final customer. Small boutique retailers will not have the market power to buy directly from the factory. Going through a distributor means an additional step and an additional layer of tax in the pyramid. Similarly, small farmers typically sell through a co-op or other middleman, adding yet another step and increasing the tax. Conversely, large businesses could consolidate farm, mill, and factory into a single entity and reduce the tax. Another principle of good tax policy is that taxes should not pick winners and losers—a tax that benefits large businesses to the detriment of smaller ones is a bad tax.

How to avoid pyramiding.

Illinois, like other states, has a number of features in the tax code designed to minimize tax pyramiding and ensure that tax is imposed only once, at the final step in the chain of commerce. As discussed above, this is sound tax policy necessary to ensure the proper functioning of the sales tax and NOT a “loophole” or giveaway to a particular industry or business. These provisions to eliminate double (or triple, or more) taxation range from broad exclusions to very narrowly crafted exemptions.

Sale for resale. The broadest provision is commonly referred to as the “sale for resale” exclusion. A well-designed sales tax applies only to retail transactions, so when an item is purchased for resale, there should be no tax. Illinois’ tax applies only to sales at retail, and the definition of that term excludes purchases of items that will be resold. [Retailers’ Occupation Tax Act (“ROTA”) §1, 35 ILCS 120/1]

Ingredient/component part. A variation on the sale-for-resale theme is the ingredient or component part exemption. In our example, the wool fabric used to make the trousers is clearly a component part of the finished product which will be resold, so it should not be taxed. Illinois adopts this exemption by excluding sales of ingredients from its definition of a “sale at retail.” [ROTA §1]

Machinery and equipment. More than just raw materials are involved in creating a finished good for its final retail sale to the consumer, and one of the most obvious is the machinery. In our example, the mill uses looms and the factory uses sewing machines. The cost of these items is incorporated into the price of the fabric or trousers. In other words, taxing the machinery and equipment used in these processes would result in tax pyramiding. Illinois has a general machinery and equipment exemption, as well as several more specific ones clarifying eligibility for exemption, like the one for farm equipment and machinery. [ROTA §2-5(14) and (2), respectively]

Production-related items. To further avoid pyramiding, things that are used in the manufacturing process but are not incorporated into the final product that will be sold, such as oils to keep the loom running smoothly, should also be exempt from tax. In Illinois, the machinery and equipment exemption has been expanded to cover many of these items [ROTA §2-45], and there are also some specific exemptions like the one for farm chemicals [ROTA §2-5(1)].

Additional exemptions. Not everything purchased during the course of preparing an item for its final sale to the consumer is covered by the exemptions and exclusions described above, so we are still left with some tax pyramiding. Exempting all business purchases would solve that problem, but no state has gone that far. Instead, at least some of the remaining gaps are filled through a variety of specific exemptions designed to eliminate double-tax in particular situations.

Taxing Services—the Same Principles Apply

When Illinois and many other states first enacted sales taxes, the bulk of the US economy was goods-oriented. Not surprisingly, sales taxes focused on taxing goods. As the economy evolved to become more service-oriented, some but not all states’ tax bases have followed suit.

Including services in the tax base can be a good thing. Numerous studies have estimated the additional revenue Illinois could generate if the tax base included the same services taxed by our neighboring states. Or, if additional revenue is not the goal, lower tax rates on an expanded base could generate the same revenue. From a tax policy perspective, a broader base would eliminate some inequities in our tax structure: if you buy a bottle of nail polish, you pay tax, but if you can afford to get a manicure, under our current structure you aren’t taxed (other than your share of the tax the manicurist paid on that bottle).

Taxing services isn’t easy. There are two major concerns with expanding the sales tax base to include services. First is the need to avoid pyramiding—as with goods, the appropriate exemptions and exclusions must be in place. The only time a service should be taxed is when it is being purchased by the final consumer. In our example, if the factory hires an outside fashion designer to create the patterns for the trousers, those services should not be taxed any more than the wool fabric used to create the trousers. Taxing either results in pyramiding.

The second problem with taxing services is logistical. Illinois can only tax goods that are sold or used in-state, which is usually an easy question to answer: where are the trousers? The same is not always the case with services, particularly professional services. In our example, assume the retail chain has stores in ten Midwest states and hires a New York City law firm to help with a federal income tax matter, and the primary attorney on the project works remotely from her home in New Jersey. If legal services were subject to sales tax, which state(s) would tax the fees? These questions are less thorny when the taxing regime properly excludes business-to-business services from tax (it is much easier to identify where a manicure or landscaping occurs), but it can still get complicated: assume the factory in our example is in Chicago, one of the shift supervisors lives in Indiana, and on a friend’s recommendation she hires a lawyer in Milwaukee to write her will. What state would tax that fee—the one where the lawyer is (Wisconsin), where the client’s only assets are (a house in Portage), or where the client is when they talk about the project during her lunch breaks (Illinois)? To minimize complexity, most supporters of taxing services agree that professional services (medical, legal, etc.) should be excluded.

Conclusion

Exempting business inputs from sales tax is not a tax loophole; it is merely an attempt to follow sound tax policy and prevent double taxation. This allows consumers (the true tax-payers) to know exactly how much tax their government is imposing on them, and eliminates preferences in the tax code for large businesses over smaller ones. Taxing services is not inherently a bad idea, but only if the same safeguards against tax pyramiding are in place.

*Carol Portman has been the President of the Taxpayers’ Federation of Illinois since 2013.