Aurora: Tops in Effective Tax Rate; Low in Local Government Spending – Mike Klemens

Aurora: Tops in Effective Tax Rate; Low in Local Government Spending

November 2019 (72.8)

By Mike Klemens*

Illinois has won a dubious first place position in the plethora of state tax comparisons. Among the largest cities in each of the 50 states, Aurora has been determined to have the highest effective property tax rate. The annual study done by the Minnesota Center for Fiscal Excellence and the Lincoln Institute of Land Policy, 50-State Property Tax Comparison Study For Taxes Paid in 2018, puts the effective rate in Aurora at 3.655 percent – highest among the 50 states and more than 2.5 times the U.S. average of 1.443 percent. The study also contradicts the common assumption that tax rates are high because spending by local governments is high.

Before we go further, we need to explain how Aurora got to be the largest city in Illinois for the purposes of this study. The authors determined that the tax systems in place in Chicago and New York City differed from systems in other cities in those two states, so they added the second largest cities in New York and Illinois — Buffalo and Aurora, together with Washington D.C. — and compared taxes in 53 cities, instead of just the largest in each state. The effective tax rate in Chicago (Illinois’ real largest city) was 1.628 percent, less than half of Aurora’s, and 17th highest.

The difference between Aurora and Chicago is more significant than the 40-mile trip. The cities are under two fundamentally different property tax systems – Chicago operating under Cook County’s classification system and Aurora under the non-classified system in place in the other 101 counties. More about that later.

The 50-State Study computes the effective tax rate by starting with a Census Bureau median valued home, takes into account the level of assessment from sales ratio studies, equalization factors, exemptions and credits to get taxable value. It applies the relevant tax rate to compute a tax bill. Then it divides the tax bill by the house value to get the effective tax rate.

The study does this two ways: (1) for the largest city in each state plus Aurora, Buffalo, and Washington D.C. as outlined above and (2) for the 50 largest cities in the country, where cities like Cheyenne, WY, Burlington, VT, and Aurora are pushed off the list and replaced mostly by large cities in California and Texas. Then the two lists are combined and duplicates eliminated to arrive at a list of 73 large U.S. cities, the list we will focus on for the rest of this article. Aurora kept its 1st place position on the 73-city list while Chicago fell to 26th.

The 50-State Study attempts to explain why property taxes differ across the 73 large cities and identifies factors that contribute to differences in effective residential tax rates. Those factors include

(1) Property tax reliance,

(2) Property values (median home values),

(3) Local government spending, and

(4) Classification ratio.

The big surprise, at least to those who attribute high property taxes to high local government spending: Aurora had the highest effective tax rate of the 73 cities but stood only 57th in local government spending. Before we go further, let’s consider the four factors above.

Property Tax Reliance

Property tax reliance is a measure of the extent to which taxing districts within a city draw on revenues other than property taxes to pay for their operations. If those taxing districts raise revenue through other sources, they needn’t impose property taxes at as high a level. The authors compare Bridgeport, CT, whose 3.44 percent residential effective tax rate was second highest, to Birmingham, AL, whose 0.66 percent effective tax rate was 10th lowest, and point out that when local sales, income and other taxes are included, Birmingham’s local per capita local taxation is higher despite its lower reliance on property taxes.

Had the authors chosen Aurora with its highest 3.65 percent effective tax rate, they would have found the same thing. In Birmingham $854 of its total local per capita tax of $2,805 came from the property tax. In Aurora $1,848 of its total local tax revenue of $2,239 came from property tax. Even with Aurora’s much higher property tax, Birmingham’s local sales, income and other taxes made for a higher per capita local tax bill for its residents.

The authors say property tax reliance accounts for 24 percent of the variation among cities’ effective property tax rates.

For Illinois, among the 73 cities nationwide:

- Aurora ranks 4th highest (69 percent of local government revenues from property tax)

- Chicago ranks 38th highest (39 percent of its revenues from property tax)

Property Values (median home values)

The second major factor in explaining the variance among cities’ property tax rates, according to the study, is property values, as measured by median home values. The notion here is that a city with high property values can impose a lower tax rate yet generate more money than can a city with low property values. As a result, cities with lower valued homes will have higher rates. In Aurora, the owner of a median valued home will pay $6,494 in property taxes annually while in Los Angeles the owner of a median valued home will pay $7,655 in property taxes, despite Aurora’s effective tax rate being nearly three times higher. That’s because the median home value is $177,700 in Aurora and $647,000 in Los Angeles.

According to the 50-State Study, median home values account for 39 percent of the variance in effective tax rates, the biggest factor.

For Illinois, of the 73 cities in the study:

- Aurora ranks 45th (median value $177,700)

- Chicago ranks 25th (median value $255,900)

Local government spending

The third factor is local government spending measured on a per capita basis. The principle is that the more taxing districts in a city spend, the higher taxes will have to be. The authors note that needs – numbers of school age children and relative crime rates – will drive spending differences. So will costs of living – in some cities more will have to be paid public employees to attract qualified workers.

The study finds that local government spending accounts for 8 percent of the variation in effective tax rates among cities.

In Illinois, among the 73 cities studied:

- Aurora ranks 57th ($4,631 in local government spending per capita)

- Chicago ranks 9th ($8,928 in local government spending per capita)

Classification

The final factor found to influence effective residential property tax rates is the classification ratio – the extent to which property taxes are shifted off homesteads and onto commercial properties and apartments. As we noted above, Cook County is the only county in Illinois that classifies property – assessing residential property at 10 percent of market value and commercial property at 25 percent. Aurora on the other hand is primarily in Kane and DuPage Counties, which value property at 33.3 percent of market value. Chicago homeowners, along with residents in other Cook County communities with large commercial or industrial bases, particularly benefit as tax burden is shifted off them onto commercial properties.

Looked at from a different source, Department of Revenue property tax statistics illustrate that commercial property carries 18 percent of the property tax in Aurora compared to 36 percent of property taxes in Chicago, a difference that allows homeowners to pay a smaller share of property taxes in Chicago.

According to the 50-State Study, the shift onto commercial property accounts for 6 percent of the variance in effective tax rates. The higher the rank the greater the shift.

In Illinois, of the 73 cities:

- Aurora ranks 45th for shift onto commercial and 36th for shift onto apartments.

- Chicago ranks 6th for shift onto commercial and 31st for shift onto apartments.

Effect on Rates

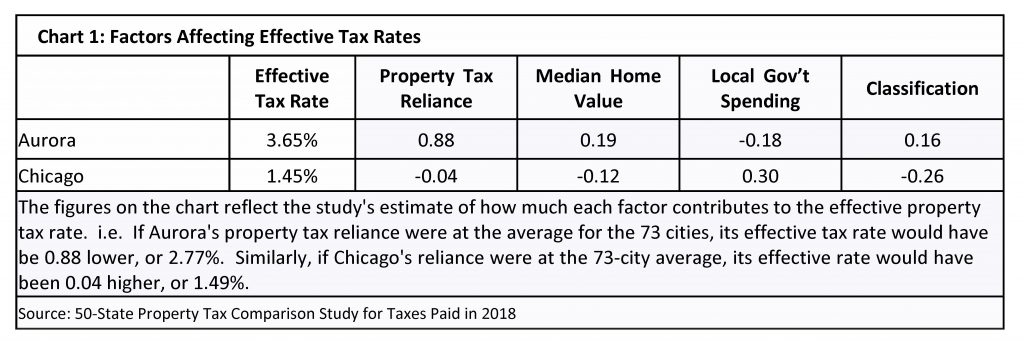

The 50-State Study goes on to attempt to quantify the amount that each of these four factors contributes to the effective residential property tax rate using a complex statistical analysis that involves regression analysis with means, standard deviations and natural logs. As shown in Chart 1, if Aurora had the average median home value for the 73 cities studied, its effective tax rate would have been 0.19 lower, or 3.46 percent. Likewise, if Aurora’s local government spending had been at the average for the 73 cities, its effective tax rate would have been 0.18 higher, or 3.83 percent. Similarly, Chicago’s effective tax rate would have been 0.30 lower (or 1.15 percent) if local government spending were at the 73-city average.

Classification provides an interesting contrast. Aurora would see a 0.16 drop in its effective residential property tax rate if it were allowed to and did classify at the national average and shifted the property tax burden onto commercial properties. Chicago, on the other hand, would see a 0.26 increase in its effective rate if it classified only at the national 73-city average.

Takeaways

The most striking thing about effective tax rates is that local government spending accounts for relatively little of the variation among cities studied – an estimated 8 percent. The result is that Aurora has the highest effective tax rate of the 73 cities in the study while spending $4,631 per capita, below the U.S. average and 57th highest among cities studied. Conventional wisdom goes out the door.

The largest factor in explaining variation in effective tax rates, median home value, also gives one pause, although for different reasons. While it is undeniable that higher tax rates would be necessary to generate the same amount of revenue in a city with lower property values, those same lower property values could make the city more attractive to individuals who are looking for a home to purchase. It seems little consolation to a homeowner that he/she is paying a lower tax rate on a more expensive home if it is more than offset by higher mortgage payments. The bottom line for the homeowner is how much he/she needs to spend to have a place to live.

For Aurora, the biggest explanation for its variance from the average city is its high reliance on property taxation, again a bit of a double-edged sword. Presumably if Aurora residents paid more in non-property taxes, their effective property tax rate could come down. Chicago residents, who pay a myriad of local taxes and fees, might well have a different view.

Classification is interesting, particularly when contrasting Aurora and Chicago. Aurora, which does not classify, would have a 4.4 percent lower effective residential tax rate if it classified at the national average, while Chicago, which does classify, would have a 17.9 percent higher rate if it classified only at the national average.

Another Significant Factor

Census data points to a significant difference between Aurora and other cities: school funding and Illinois’ high reliance on the property tax to fund schools. According to data compiled by the Lincoln Institute, in Aurora nearly half of all local government spending is for schools, about 50 percent more that the average for all cities and for Chicago. Presumably, if Illinois follows through with its school funding reform initiative and directs more state money to schools, property taxes could be reduced.

Conclusion

The most unexpected finding of the 50-State Study is that high effective property tax rates don’t correlate solely with high government spending as demonstrated by Aurora with both the highest residential effective tax rate and below average per capital local government spending. Those who seek reform of Illinois property taxation need to recognize that property tax reliance and property values have a large impact on tax rates. Or, as the authors to the study say in their introduction, “High or low effective property tax rates do not in themselves indicate that tax systems themselves are ‘good’ or ‘bad.’” When it comes to property taxation, there are no simple answers.

Another View of Effective Tax Rates

The 50-State Study that we wrote about in the main article in this issue illustrates the wide variation in property tax effective tax rates (ETRs) in large cities across the country, but those same differences also occur within Illinois. According to the latest ETRs calculated by the Illinois Department of Revenue (IDOR) and published in its annual Property Tax Statistics for 2017 (taxes payable in 2018), Aurora’s ETR – tops among large cities in the 50-State Study – was squarely in the middle of the pack for cities in Illinois. Chicago, whose ETR was above average in the 50-State Study, has a relatively low ETR within Illinois.

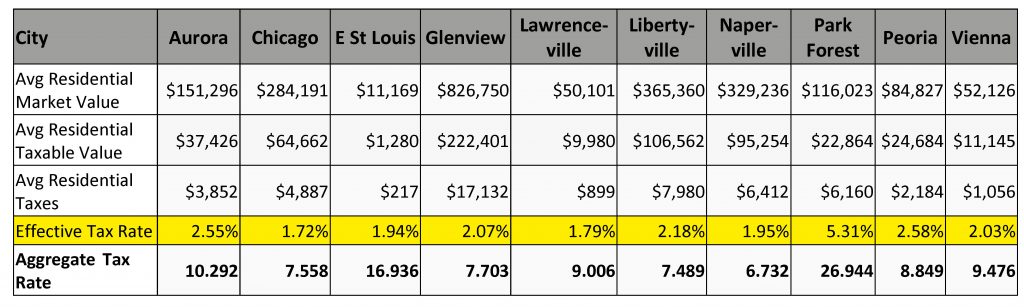

First, a caveat about the Department of Revenue Study. While the 50-State Study calculated taxes on what the Census Bureau identified as a median valued home, the IDOR study calculates the tax based on the average taxable value of a residential parcel. For Aurora the Census median was $177,700, while the IDOR average was $151,296. It arrives at the figure by dividing the taxable value for all residential property by the number of residential parcels. The IDOR has access to lots of data and it’s hard to quibble with their approach: taxable value x tax rate = tax bill. The IDOR methodology accounts for all homestead exemptions instead of just the general homestead exemption used in most other studies. However, in cities with vacant residential property or distressed housing, low valued residential properties may depress the average below that of a typical house. Conversely, cities with an above typical percentage of high value homes would have the opposite effect. What the IDOR approach yields is an average effective rate per residential parcel.

For a more complete discussion of implications of using fixed, median, or average home values in computing effective rates, see “Other Ways of Calculating Effective Tax Rates,” Tax Facts, March 2018. The results of the IDOR calculations are displayed on the chart below for 10 representative cities across Illinois, the same 10 we looked at in the 2018 article. Aurora, which had the highest effective tax rate in the 50-State Study was third in this sample of 10, behind Park Forest and Peoria. More broadly, of the 448 locations for which IDOR calculated average residential parcel effective property tax rates, 182 were higher than Aurora’s.

Chicago, meanwhile, which had an above average effective property tax rate in the 50-State Study, had the lowest effective residential property tax rate of the 10 cities in the chart. Among all the locations studied by IDOR, only 21 had a lower rate than Chicago.

Turning to average residential tax bills, the differences are even more striking. Among our 10 selected cities, five had higher average residential tax bills than did Aurora, even with its highest-in-the-country effective tax rate in the 50-State Study. And although Chicago had the lowest effective tax rate of the 10 cities chosen from the IDOR study, owners of median valued homes in four of the other nine had higher property tax bills.

Conclusion

The IDOR study validates the 50-State Study. Low effective tax rates are tied to high property values, and low property values are tied to high aggregate tax rates. However the IDOR study demonstrates that even with a lower effective tax rate, higher valued properties tend to have higher tax bills. For those concerned with property tax reform in Illinois, the IDOR study reinforces the wide variation in property taxation within Illinois that they will confront. A one-size-fits-all solution will prove difficult to achieve.

* Founder of KDM Consulting Inc., does tax policy research for the Taxpayers’ Federation.

Printer friendly version