2019 Year in Review – Maurice Scholten

2019 Year in Review

January 2020 (73.1)

By Maurice Scholten*

Our annual summary of major tax-related legislation follows. We’ve presented the changes by tax type and topic, rather than by bill number. As the discussion indicates, there were several bills that made significant changes to several tax provisions, and sometimes subsequent follow-up bills making additional changes to those same provisions. Our focus is on the outcome as it impacts taxpayers, so we have arranged the summary accordingly.

FY 2020 BUDGET

The General Assembly failed to pass a budget by May 31 last year, but in early June passed a budget, a new capital bill, and other significant legislation–with bipartisan support. General Revenue appropriations increased from $37.221 billion to $ 38.460 billion, a 3% increase.

Budget Implementation Bill

P.A. 101-0010 is the FY2020 Budget Implementation Act (traditionally called the “BIMP”) and contains numerous statutory changes required to make the budget “work” such as amending statutory transfers between funds. A BIMP often includes tax changes, and this year is no different. The bill’s changes to the sales tax on aviation fuel will be discussed later, but two of its budget-related changes warrant noting here.

Local Government Distributive Fund – Municipalities receive a portion of income tax that is collected by the State. In FY 2018, the State reduced this amount by 10%. In FY2019, the reduction was 5%. The BIMP extends the 5% reduction for another year, through FY 2020.

Public-Private Partnership – The BIMP also created the Public-Private Partnership for Civic and Transit Infrastructure Project Act. This language allows the State to enter into a public-private agreement with a private entity (a developer) in order to provide financing for a project south of downtown Chicago, currently called One Central. The financing from the State would be from future tax revenues generated from the development site. In exchange, the developer would make improvements to public transit in the area. No such agreement between the State and the developer has been entered into as of publication.

INCOME TAX

Graduated Income Tax

This November, Illinois voters will decide whether the current state constitutional prohibition of a graduated income tax should be repealed. The General Assembly passed the necessary resolution, SJRCA 1, in May to put the question on the ballot. They also passed P.A. 101-0008 which creates graduated income tax brackets and new tax credits that will go into effect only if the constitutional amendment is adopted. The new brackets will apply for tax years beginning on or after January 1, 2021. The highest bracket applies to income over $1,000,000 for married filing jointly taxpayers. Income over that amount would be taxed at 7.99%. The residential property tax credit is increased from 5% to 6% of property taxes paid. A new child tax credit is created with a maximum credit of $100 per child.

Federal Tax Reform Related Changes

P.A. 101-0009 decouples from the federal deduction for 37.5% of FDII (foreign derived intangible income) in Internal Revenue Code §250. The federal deduction was part of the Tax Cuts and Jobs Act and was designed to effectively lower the tax rate on that category of income. Illinois does not follow federal rates, so is decoupling from the deduction.

The bill also allows a deduction for trusts and estates equal to the amount of “excess business loss” disallowed by Internal Revenue Code §461(l)(1)(B). The Tax Cuts and Jobs Act disallows certain losses and requires them be treated like NOLs. In Illinois, trusts and estates do not have NOL carryovers, so they would never be allowed to deduct these losses, absent this new provision.

Taxation of Non-Residents & Credit for Taxes Paid to Other States

P.A. 101-0585 taxes non-residents who spend more than thirty working days in Illinois starting in 2020. Employers will have to adjust withholding on these traveling employees if they exceed the thirty-day threshold. Illinois residents will now receive a credit for taxes paid to other states if they are based in Illinois but pay income taxes to other states for days spent in those states.

Research & Development Tax Credit

P.A. 101-0207 extends the research and development tax credit until January 1, 2027.

Apprenticeship Education Expense Credit

P.A. 101-0207 creates an apprenticeship education expense credit. This credit is equal to tuition or other expenses at a school or community college for a full-time apprentice paid for by the employer, up to $3,500 per apprentice. (Under the current EDGE, a taxpayer can get a credit only for its own employees.) The employer can receive an additional $1,500 if the apprentice is from an underserved area. The maximum aggregate amount of credits that can be claimed per year is $5,000,000.

Blue Collar Jobs Act

P.A. 101-0009 creates four new or expanded income tax credits, beginning January 1, 2021. All four are very similar, although targeted at different existing economic development programs and with differing investment level and pre-approval requirements: High Impact Businesses, Enterprise Zones, EDGE Agreements, and River Edge Redevelopment Zones. The credits are equal to up to 50% (or, in some instances, 75% if the project is in an underserved area) of income tax withheld from construction project contractor and subcontractor employees. Unused credits can carry forward five years; credits earned by pass-through entities flow through to the owners.

Data Centers

P.A. 101-0031 & P.A. 101-0604 created an income tax credit for data centers in Illinois. A “qualifying Illinois data center” is one where the owner and tenants collectively make a capital investment of $250 million over a 5-year period, creates 20 new jobs (earning over 120% of that county’s median full-time wage), and is either carbon neutral or achieves a green building certification. The credit is equal to 20% of the wages paid to contractors of the data centers if the data center is located in an underserved geographic area.

Estimated Payments

P.A. 101-0355 increased the amount of estimated tax, from $500 to $1,000, before a taxpayer must make estimated tax payments. The change is for tax years ending on or after December 31, 2019.

Charitable Organizations

P.A.101-0545 creates an income tax deduction for tax-exempt entities. As a result of the Federal Tax Cuts and Jobs Act of 2017, tax-exempt entities must pay tax for qualified transportation fringe benefits provided to their employees (either parking or contributions to a pre-tax qualified plan). This bill creates a subtraction at the State level equal to this amount, meaning tax-exempt entities would not have to pay Illinois income tax due to the change at the federal level. However, the federal law was repealed in December 2019.

Income Tax Surcharge on Sale of Assets for Gaming Licensees

P.A. 101-0031 creates an income tax surcharge on income arising from the sale or exchange of capital assets, depreciable business property, real property used in the trade or business, good will, or other intangible assets of (i) an organization licensee under the Illinois Horse Racing Act of 1975 and (ii) an organization gaming licensee under the Illinois Gambling Act. There are a number of exemptions as to circumstances where the surcharge does not apply, such as a bankruptcy. The surcharge is equal to the amount of the federal income tax liability attributable to the sale.

Gambling Income

P.A. 101-0031 makes winnings earned by non-residents at an Illinois casino taxable by Illinois. This also allows residents of Illinois who receive winnings in other states, and pay taxes on the winnings to those states, to claim a credit for the taxes paid to those states. This provision applies starting with the 2019 tax year. Additionally, businesses required to withhold federal income taxes from gambling winnings must also withhold Illinois income taxes from those payments to residents and non-residents.

Film Tax Credit Extension

P.A. 100-0178 extends the film tax credit through January 1, 2027.

SALES TAX

Marketplace Facilitator

P.A. 101-0009 and P.A. 101-0604 require certain marketplace facilitators to collect use tax on sales made on their marketplace, effective January 1, 2020. Only marketplace facilitators that either (i) have sales of $100,000 or more to Illinois residents either by the facilitator or sellers on their marketplace or (ii) enter into 200 or more transactions with Illinois residents will be impacted. Marketplace sellers that already collect use tax on sales to Illinois residents will no longer be responsible for the tax on marketplace transactions if the marketplace facilitator is required to collect the tax. However, marketplace sellers will continue to collect tax on sales outside of the marketplace. And, sales made on a marketplace that are subject to sales tax, rather than use tax, are not included in these provisions. The marketplace facilitator can use its systems to calculate and collect the tax, of course, but the seller itself will continue to be the party required to report and remit the tax to the State. The turmoil to Illinois’ sales and use tax structure created by these changes and those discussed in the next paragraph will be covered in more detail in future Tax Facts.

Leveling the Playing Field for Illinois Retail Act

P.A. 101-0031 and P.A. 101-0604 require out of state retailers without a presence in Illinois to collect retailers’ occupation tax instead of use tax beginning on January 1, 2021. These retailers will collect the ROT rate where the items are shipped to. Retailers with an Illinois presence would not be affected by this law and would continue collecting use tax or retailers’ occupation tax, depending on the nature of the transaction.

Expanded Manufacturing Machinery & Equipment Exemption

P.A. 101-0009 expands the manufacturing machinery and equipment exemption to include production related tangible personal property (such as supplies and consumables, hand tools, protective apparel) purchased on or after July 1, 2019. P.A. 101-0604 removes the requirement of a separate exemption certificate for each transaction.

Sales Tax Trade-In Credit

P.A. 101-0031 limits the sales tax trade-in credit for motor vehicles of the first division (vehicles designed to carry ten people or less) to $10,000 beginning January 1, 2020.

Sales Tax on Aviation Fuel

The Federal Aviation Administration requires any state or local taxes on aviation fuel imposed after December 30, 1987 to be used for airport related purposes. In order to be in compliance, the legislature included language in the BIMP, P.A. 101-0010, and then subsequently amended that language with P.A. 101-0604. The local share of the 6.25% sales tax collected on aviation fuel must now be deposited into a new State Aviation Program Fund. Any local sales taxes on aviation fuel are deposited into the Local Government Aviation Trust Fund. If the local government cannot expend the funds for a proper purpose, then the fuel is exempt from that local tax. The State motor fuel tax still applies to aviation fuel (unless otherwise exempted), but all aviation fuel is exempted from local motor fuel taxes.

Data Centers

P.A. 101-0031 and P.A. 101-0604 create a sales tax exemption for data centers in Illinois. A “qualifying Illinois data center” is one where the owner and tenants collectively make a capital investment of $250 million over a 5-year period, creates 20 new jobs (earning over 120% of that county’s median full-time wage), and is either carbon neutral or achieves a green building certification.

Non-Home Rule Municipal Sales Tax

P.A. 101-0047 allows non-home rule municipalities that have enacted a local sales tax by referendum after July 14, 2010 to continue to use the proceeds for public infrastructure or property tax relief until July 1, 2030.

PROPERTY TAX

Senior Homestead Exemption

P.A. 101-0453 and P.A. 101-0622 create a pilot program for Cook County where senior homestead exemptions will be renewed automatically. The County Assessor must work with the County Clerk and the Department of Public Health to obtain information on taxpayers that have died. This pilot program goes through the 2023 tax year, unless extended by the General Assembly.

Leasehold Taxes

P.A. 101-0551 makes two changes. Lessees of property in Chicago owned by a local government, leased to a non-exempt entity, and used as an airport or a waste disposal or processing facility will be subject to property tax. Additionally, for property in Chicago that is owned by a local government and leased to a non-exempt entity for parking, only the portion used for parking is exempt from property tax.

Peotone Airport Property Taxes

P.A. 101-0532 extends and modifies special property tax provisions for property held for the future Peotone airport. For properties that the State owns and leases, an amount equal to the property taxes that would be due is included in rent and sent to the various taxing districts. Previously, the amount was frozen at the 2002 tax level. This bill sets the amount equal to the taxes that would have been due for the current tax year, with an aggregate cap of $600,000.

Illinois Property Tax Relief Fund

P.A. 101- 0077 creates the Illinois Property Tax Relief Fund. The fund will be used to issue rebates to homeowners that have a general homestead exemption. However, the bill does not provide a funding mechanism, meaning no rebates will be issued unless a future bill provides funding.

Property Tax Relief Task Force

P.A. 101-0181 creates the Property Tax Relief Task Force, which is tasked with submitting a report to the General Assembly by January 1, 2020. The report is to outline “short-term and long-term administrative, electoral, and legislative changes needed to create short-term and long-term property tax relief.” As of date of publication, a report has not been submitted.

High Speed Rail Property Tax Assessments

P.A. 101-0186 extends the special assessment for high speed rail. Specifically, investment, improvement, replacement, or expansion of railroad property for high speed passenger rail will not increase the property’s assessment.

Assessment as a Water Treatment Facility

P.A. 101-0199 updates the process to get assessed as a water treatment facility. Under the new process, the owner files the application with the Department of Revenue rather than the Department of Natural Resources. To qualify, the applicant must have a facility number issued by the Illinois Environmental Protection Agency.

Lessee Property Taxes

P.A. 101-0198 only applies to DuPage County. It provides a mechanism for the State’s Attorney to bring an action in court against an entity that leased property from a taxing district and has not paid the property taxes.

Tax Sales

P.A. 101-0379 allows counties other than Cook County to have a joint tax sale. Additionally, if a sale in error is granted due to hazardous waste, the court may assign the certificate of purchase to the county collector.

TIF Info on Property Tax Bill

P.A. 101-0134 requires that a property tax bill indicate which tax increment financing district a property is in, and how much of the property taxes on that property go to the tax increment financing district.

County Assessors

P.A. 100-0150 allows counties other than Cook County to transition from an appointed Supervisor of Assessment to an elected one. To transition, the county board must pass an ordinance or a petition with signatures of 2% of the registered voters in the county must be filed. If either requirement is met, a referendum would be held at the next election.

Mobile Home Local Services Tax Penalty

P.A. 101-0454 sets a maximum penalty amount in DuPage County for the mobile home local services tax. The penalty is $25 per month, but this law limits the penalty to the lesser of (i) $100 or (ii) 50% of the original tax.

Assessor Qualifications

P.A. 101-467 updates the qualifications needed to be a township assessor or a county supervisor of assessments.

TIF Extensions

P.A. 101-0618 allows for a twelve-year extension of a tax increment financing district in Savanna.

P.A. 101-0274 allows for the extension of a TIF district in Phoenix, Swansea, Saunemin, Romeoville, Berwyn, and Hanover Park.

MISCELLANEOUS

Recreational Adult Use Cannabis

The General Assembly passed P.A. 101-0027 in May, legalizing adult use cannabis beginning in 2020. In November, P.A. 101-593 made technical corrections to the bill. As a whole, the bills impose a 7% tax on the cultivation of cannabis which is measured on the selling price from the cultivator to the dispensary. This same tax currently applies to medicinal cannabis. A Cannabis Purchaser Excise Tax is also imposed on recreational cannabis, measured on the selling price of the cannabis with a rate that varies depending on the THC level of the cannabis. The rate is 10% for cannabis with a THC level of 35% or less, 25% for levels higher than 35%, and 20% for cannabis infused products. All recreational cannabis will also be subject to the higher sales tax rate unless purchased for medicinal purposes. Municipalities can impose a 3% tax on the selling price of cannabis sold within their borders. Counties can also impose a tax of 3.75% for sales in unincorporated areas and 3% for sales within a municipality. The Cannabis and Controlled Substance Tax Act, which was previously ruled as unconstitutional, was repealed.

Motor Fuel Tax Increase

P.A. 101-0032 increased the motor fuel tax from 19¢ a gallon to 38¢ a gallon. The increase was effective July 1, 2019 and will increase each July 1 by the rate of inflation. The bill also increased the additional motor fuel tax for diesel and other fuels from 2½¢ a gallon to 7½¢ a gallon. The bill allows municipalities in Cook County to impose a motor fuel tax, up to 3¢ per gallon. Previously, only home rule municipalities and those with a population over 100,000 could impose a motor fuel tax. The bill expands the county motor fuel tax by adding Lake and Will to the list of counties that can impose a motor fuel tax (DuPage, Kane, and McHenry are already included). The maximum county motor fuel tax increases from 4¢ to 8¢ a gallon. The bill shifts the revenue the State receives from the sales tax on motor fuel from the General Fund to the Road Fund over 5 years. The bill does not affect how local governments receive sales tax from motor fuel.

Franchise Tax Repeal

P.A. 101-0009 phases out the franchise tax over four years. In 2020, every corporation’s franchise tax liability will be reduced by $30. In 2021, the reduction will increase to $1,000, then $10,000 in 2022, then $100,000 in 2023 and in 2024, no tax will be due.

Tax Amnesty

P.A. 101-0009 created a tax amnesty program for all taxes administered by the Illinois Department of Revenue. The applicable period ran from October 1 through November 15, 2019. Taxes due for any taxable period ending after June 30, 2011 and prior to July 1, 2018 were eligible. Interest and penalties were waived. Unlike previous Illinois amnesties, there was no penalty imposed on taxpayers eligible for amnesty who do not participate in the program.

Franchise Tax Amnesty

P.A. 101-0009 also created an amnesty program for all franchise taxes and license fees imposed by Article XV of the Business Corporation Act for any tax period ending after March 15, 2008 and on or before June 30, 2019. The amnesty period ran from October 1 through November 15, 2019.

Parking Excise Tax Act

P.A. 101-0031 creates the new Parking Excise Tax Act which imposes a 6% tax on parking spaces paid for on a weekly basis or less and 9% on spaces paid for on a monthly basis or more beginning January 1, 2020. Certain leases are exempt, such as a lease for a parking space between an apartment tenant and the landlord. Hospital employees are also exempt if the space is owned and operated by the hospital. Proceeds from the tax are to be deposited into the Capital Projects Fund.

Cigarette Tax

P.A. 101-0031 increases the tax on cigarettes by $0.50 per cigarette, or $1 per pack. The proceeds from this additional tax will be deposited into the Capital Projects Fund. The bill expands the Tobacco Products Tax of 1995 to tax electronic cigarettes at 15% of the wholesale price.

Minimum Wage Tax Credit

P.A. 101-0001 increases the minimum wage statewide over a number of years, beginning with an increase to $9.25 an hour in 2020 from the previous minimum wage of $8.25. The bill also creates a withholding tax credit for employers with fifty or fewer full-time employees. In the first year, the credit is equal to 25% of the difference between the minimum wage in 2020 and the minimum wage in 2019. The percentage is reduced each year.

Municipal Hotel Operators’ Tax

P.A. 101-0204 allows municipalities in DuPage County that belong to a not-for-profit organization that is a certified local tourism and convention bureau to use 25% of the proceeds of the municipal hotel operators’ tax on economic development or capital infrastructure.

Sports Wagering Tax

P.A. 101-0031 creates a legal framework for legalized sports wagering. The details of the framework are outside the scope of this article, but it is worth noting that there is a 15% tax imposed on the master sports wagering licensee’s adjusted gross sports wagering receipts from sports wagering. There is an additional 2% tax on the adjusted gross receipts from sports wagers that are placed in Cook County.

BILLS ON GOVERNOR’S DESK

3rd Party Sales Tax Audits

SB 1881 creates two related programs, the Local Government Recapture Act and the Local Government Revenue Recapture Certified Audit Pilot Program. The Local Government Recapture Act creates a process for a third party to become registered with the Department of Revenue, and then enter into contracts with municipalities to review their local sales tax information. The third party is prohibited from contacting taxpayers, but if they believe a local retailers’ or service occupation tax was underpaid, they can refer the matter to the Department. The bill also creates penalties for violations of the Act, including misuse or disclosure by the third party of any taxpayer information. The second portion of the bill creates the Local Government Revenue Recapture Certified Audit Pilot Program. This program outlines how the Department can respond to referrals of underpaid local retailers’ or service occupation taxes. Additionally, it creates a process for certified public accountants to become a qualified practitioner, and then can perform certified sales tax audits on behalf of the Department in response to a referral.

*Maurice Scholten is the Legislative Director of the Taxpayers’ Federation of Illinois.

The Long Road to Restoring Illinois’ Fiscal Health

By Mike Klemens*

A recently released financial report provides a snapshot of where Illinois state government stood financially on June 30 and underscores the fiscal challenges that Illinois faces. According to the Illinois Comptroller’s Traditional Budgetary Financial Report for 2019, between 2018 and 2019 state revenues fell about 4 percent while overall spending was about the same. Based on the budgetary balance concept the report uses, Illinois ended FY 2019 in roughly the same financial position as it had begun.

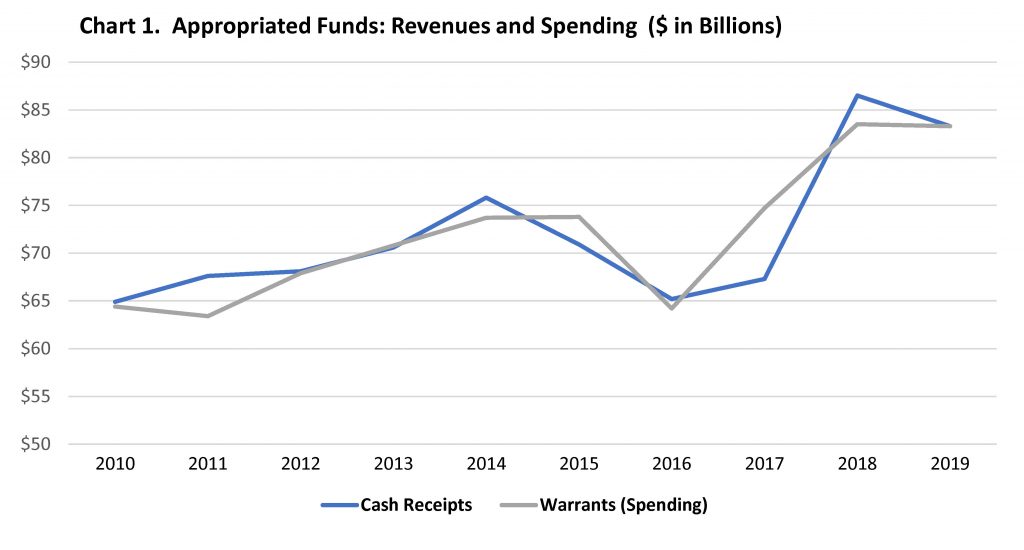

Chart 1 on page 10 shows Illinois revenues and spending for all appropriated funds for the last 10 years. The volatility of the state’s financial condition is clear. Spending increased after the mid FY 2011 income tax rate increase, declined after the rates were rolled back in mid FY 2015 and increased again after the FY 2017 income tax restoration.

The comptroller’s traditional budgetary report offers a clearer picture of Illinois’ fiscal position than simply looking at money in the bank at the end of the year, named the “available balance” concept. Under the Illinois system, revenues are credited to the budget year they are received but spending from a budget can extend into the “lapse period,” as much as six months after the end of the fiscal year. The traditional budgetary report takes into account the amount of one year’s revenues used to pay previous years’ bills.

It was not a tax shortfall that caused the 2019 revenue decline. Income tax receipts rose nearly 10 percent and sales tax grew almost 9 percent. The culprit is the October 2017 bond issuance that was used to pay old bills. Those bond proceeds provided a one-year boost of $6 billion to all funds revenues in FY 2018. In FY 2019, even with higher tax receipts, total revenues were still down $4 billion.

The same thing happened on the spending side of the budget where paying off the old bills with a one-time revenue infusion from the bond sale boosted FY 2018 spending.

Looking at the general funds on an available balance (money in the bank) concept, on July 1, 2018, Illinois had $125 million in the bank. Between July 1, 2018, and June 30, 2019, it received $40,195 million in revenues (taxes, transfers from other state funds, and from the federal government) while spending $39,854 million (operations, grants, refunds, permanent improvements and transfers to other state funds). The general funds ended the year with $466 million in the bank. Sounds like a good year. More money came in than was spent.

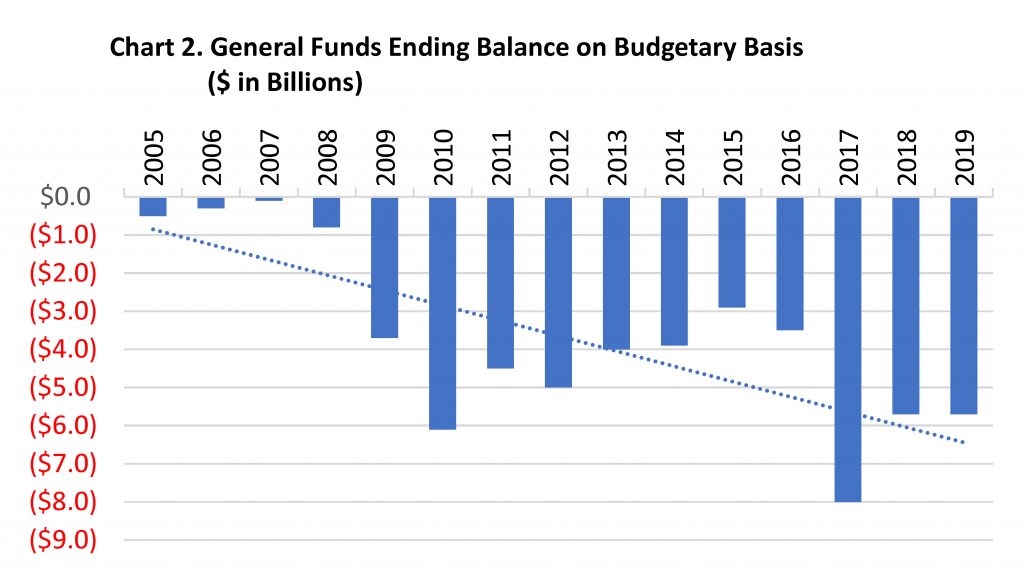

Now let’s look at FY 2019 general funds from the budgetary balance concept, an approach that identifies spending that is being pushed from one year into the next. Start with the same $125 million in the bank on July 1, take out the FY 2018 spending that was pushed into FY 2019, and you start with the fund balance on a budgetary basis that is – $5,698 million. Then do the same thing, for the June 30, 2019 ending balance. Start with the $466 million, take out the FY 2019 spending that was paid for during the lapse period using 2020 receipts, and you get a budgetary basis to begin FY 2020 of – $5,713 million, just a little worse than the previous year. In other words, $5,698 million in FY 2019 revenues were used to pay FY 2018 bills and $5,713 million in FY 2020 revenues were used to pay FY 2019 bills.

The same pattern is evident if you look past the general funds to all appropriated funds.

Chart 2 gives a 15-year history of the general funds end of year balance on a budgetary basis. The last time the budgetary balance was positive (i.e. the state had enough money on hand on June 30 to pay bills it had incurred by June 30) was 2001. The trend line is clear. Budgetary balances worsened when the Great Recession hit in mid-FY 2008 and have not recovered.

The Traditional Budgetary Report also illustrates a couple of other developments:

- Increasing reliance on income taxes together with decreasing reliance on sales taxes

On the revenue side, the largest source of all funds revenue in 2019 was the income tax which accounted for 30 percent of appropriated funds revenues. Sales taxes accounted for 12 percent of total revenues. In 1999 income taxes had accounted for 25 percent of all funds revenues, a percentage that has risen with the income tax rate increases since then, and sales taxes had accounted for 18 percent of all revenues.

- Continued growth in the number of funds.

The report covers 729 “active” funds, including seven general funds. Twenty years before there were 572 active funds and four general funds. An extensive set of recommendations to increase transparency and make budgeting more understandable by consolidating funds proposed by the Institute for Government and Public Affairs have led to no changes. See “Why Ignore Over Half of the Illinois State Budget Picture? Consolidation of General and Special Fund Reporting,” Tax Facts, May/June 2012.

Conclusion

The latest Traditional Budgetary Financial Report highlights the widely recognized fiscal challenges facing Illinois. Perhaps it will give pause to policy makers and the public seeking to enact new programs. Illinois has already embarked upon, but still must fund, significant increases in state school funding. There is pressure to restore human service funding that took a beating during the years Illinois had no budget. There is demand for property tax relief. Against all these, there is still a stack of unpaid bills. Hard choices lie ahead.

* Founder of KDM Consulting Inc., Mike does tax policy research for the Taxpayers’ Federation of Illinois.